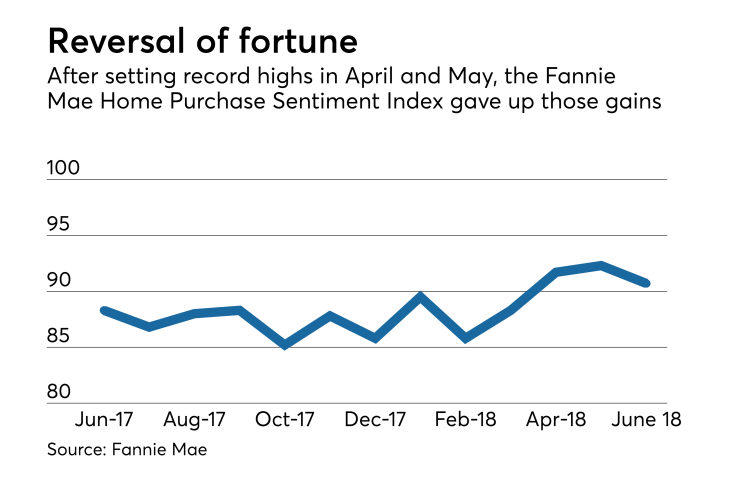

Slight declines in consumer expectations for more favorable future job security, income and interest rates knocked Fannie Mae's Home Purchase Sentiment back down from a record high in June.

The index fell by 1.6 points to 90.7 in June from an index-record high of 92.3 during

The net share of HPSI survey respondents that aren't concerned about losing their jobs fell 2 percentage points from May to 76%. So did the net share of respondents that have higher incomes than 12 months ago. The percentage of respondents reporting this is at 19%.

Respondents who consider the current market advantageous for sellers increased 1 percentage point to 47%. In addition, the net share of respondents expecting home prices to increase in the next 12 months fell by 3 percentage points and the net share considering it to be a buyer's market stayed unchanged at 28%.

The net share of respondents expecting more rates to fall in the next 12 months is -53%.

"After several years of steadily climbing, HPSI's slowing upward trend suggests the index may be reaching a plateau," Doug Duncan, senior vice president and chief economist at Fannie Mae, said in a press release. "Tight supply and lackluster income growth continue to weigh on housing activity, and consumer expectations for home price growth over the next 12 months have moderated."

Fannie conducted its phone survey of 1,000 consumers between June 1 and June 25, with most of the data collected during the first two weeks of this period.