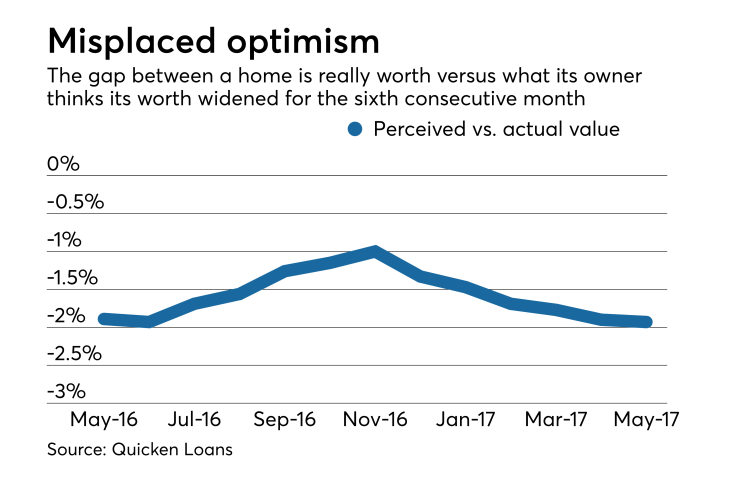

Property owners' perception of what their home is worth continued to grow faster than the actual appraised value.

Appraised property values came in 1.93% lower than what homeowners expected, according to May's Quicken Home Price Perception Index. It marked the six month in a row where the spread widened.

Last month, homeowners

Property values rose 0.63% between April and May and they are 4.92% higher than in May 2016, Quicken said.

"Home values, and home value changes, vary widely depending on the city you're in," said Bill Banfield, Quicken Loans vice president of capital markets, in a press release. "Homeowners, and those looking to buy a home, should keep a close eye on their local market to better understand home values in their area, and the trend they are on."

Appraised values in Denver and Dallas are higher than what homeowners believe, at 2.58% and 2.48%, respectively.

But Philadelphia homeowners overvalue their property by 3.32%. In Baltimore they overvalue their home by 3.1% and in Chicago by 2.62%.