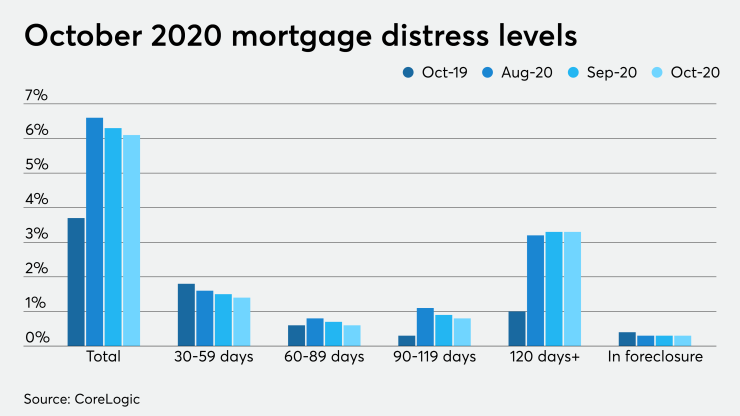

While the number of distressed mortgages continued to decline month-to-month in October, the number of serious delinquencies logged that month was three times higher than the total seen at the same time last year, according to CoreLogic.

The Loan Performance Insights Report showed that serious delinquencies — loans 90 days or more past due, including foreclosures — faded to 4.1% from 4.2% the month prior, but more than tripled

October’s overall delinquency rate decreased to 6.1% from

“After a financially challenging year, the healthy housing market and new stimulus measures are helping borrowers get back on their feet,” Frank Martell, president and CEO of CoreLogic, said in the report. “Given these variables, we should begin to see a reduced flow of homes in delinquency in the coming months.”

While the latest stimulus package provides some relief for distressed homeowners,

The rate of 30- to 59-day early-stage delinquencies edged down to 1.4% in October from 1.5% in September and 1.8% in October 2019. The rate for 60- to 89-day delinquencies crept down to 0.6% from 0.7% month-over-month, while holding year-over-year.

The foreclosure rate stayed static at 0.3% going back to April and dipped annually from 0.4% as

At the state level, the three highest foreclosure rates remain unchanged from a month ago, with rates of 1.2% in New York and 0.8% in both Hawaii and Maine. A total of 14 states tied for the lowest rate at 0.1%.

The state totals for delinquency rates stayed mostly the same from September. Louisiana had the highest delinquency rate at 10%, followed by 9.1% in Mississippi and 8.7% in New York. Idaho had the lowest delinquency rate at 3.2%, South Dakota came next at 3.4% while Montana and Wisconsin tied for third at 3.5%.