Equifax is supporting mortgage lender customer retention efforts in a tightening market.

With Equifax's launch of Mortgage Lead Generation Models, mortgage lenders can better predict the likelihood that a prospective buyer will apply for a mortgage within the next two to six months. The tool analyzes credit, wealth/asset, property and demographic data, and includes four different models to segment consumer profiles: new purchase, first-time homebuyer, refinance and home equity, according to the company.

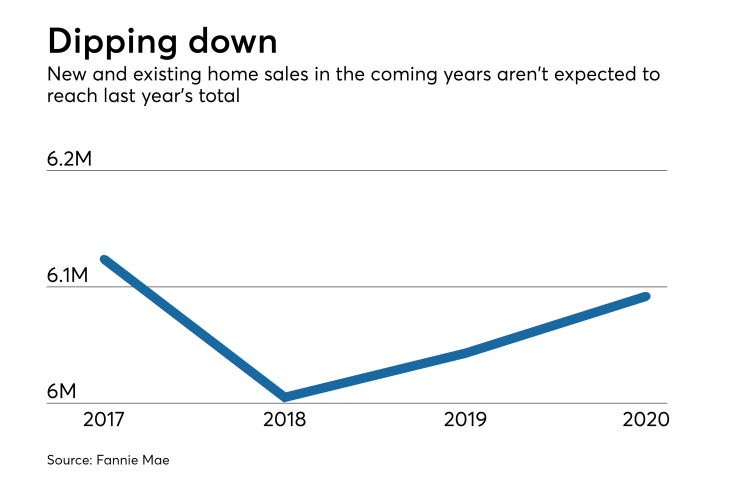

This move comes at a time where mortgage volume is falling and not expected to return to 2017 levels in the coming years, according to Fannie Mae's latest

"It's critical for mortgage lenders to get off the sidelines and become more proactive in identifying prospects and building meaningful relationships with them," Tyler Sawyer, vice president of rental and real estate at Equifax, said in a press release.

"This solution makes the data actionable to help lenders find the right customer at the right time, which is important in a highly competitive market where 55% of buyers are starting their process online," he continued.

The Equifax models develop a unique consumer score (based on lender requirements) between one and 999, with a higher score indicating a stronger likelihood that a lead will apply for a mortgage. During internal testing, the top 10% of Mortgage Lead Generation Models' scores picked up 2.4 to four times more mortgage applicants than a randomly selected group of the same size.

"Now is the time when lenders' marketing dollars have to make 'cents,' literally," said Sawyer. "Offering greater consumer segmentation can drive stronger targeted marketing."