Growing equity levels increased the share of equity-rich homes and pulled borrowers out from underwater in the third quarter, according to Attom Data Solutions.

Of the 58.9 million mortgaged homes across the U.S., 16.7 million — or 28.3% — had combined loan-to-value ratios of 50% or less, qualifying them as equity-rich. Those figures rose from 15.2 million and

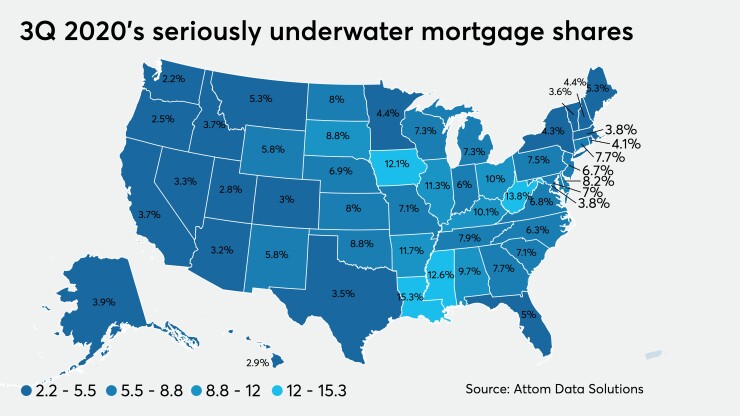

At the other end of the spectrum, 3.5 million mortgaged properties — or 6% — had LTV ratios over 125%. These seriously underwater homes went from 3.4 million and 6.2% from the quarter prior and 3.5 million and 6.5% in the third quarter of 2019.

"Homeowner equity in the third quarter added another pebble to the pile of markers showing that the U.S. housing market continues to defy the broad downturn in the economy this year," Todd Teta, Attom's chief product officer, said in the report.

Vermont topped the nation by proportion of equity-rich mortgages at 45.1%. California dropped to second place at 39.7%, as Hawaii's 39.6%, Washington's 39.6% and Idaho's 39.5% filled out the top five. The most equity-rich housing markets were all in the West. San Jose, Calif., stayed far ahead with a 63.7% share. San Francisco trailed with 49.7%, then came 44% in Los Angeles, 42% in Seattle and 40.4% in Boise, Idaho.

Louisiana once again led the country in seriously underwater property share at 15.3%. West Virginia's 13.8% followed, then came 12.6% in Mississippi, 12.1% in Iowa and 11.7% in Arkansas. At the metro area level, Baton Rouge, La., posted the highest share of seriously underwater homes at 14.5%. Youngstown, Ohio (14%), Syracuse, N.Y. (13.5%), Scranton, Pa. (13.1%) and Cleveland (12.4%) rounded out the bottom five.

While the housing market provided the economy's silver lining during the pandemic, it still faces the upcoming aftermath of the CARES Act and forbearance moratoria.

“With the foundation under the housing market still shaky as the coronavirus remains a threat, we will continue to monitor closely the various metrics, including equity," Teta said. "But as it’s been throughout the pandemic, the market is strong and homeowners remain in a position to benefit.”