The combination of rising rates and real estate prices has made home buying less affordable, reviving interest in a product that lets consumers borrow against the future equity of their homes.

In equity sharing transactions, investors provide homebuyers with a partial down payment in exchange for a share of future home price appreciation. Freddie Mac has quietly been testing out automated purchases of conforming loans with equity sharing stakes of typically 10%. The equity stake is provided to consumers by a private company that was previously knowns as FirstREX, but rebranded itself last year as Unison.

"It's a very limited pilot that we're participating in now," said Freddie Mac spokesperson Lisa Tibbitts.

Public entities have long provided a modest amount of local equity sharing in various forms to bolster lower-income borrowers' affordability, sometimes in conjunction with lenders and the agencies, said Brett Theodos, a senior research associate at the Urban Institute in Washington, D.C.

But equity sharing by public entities has its limits, whereas "if the private market can find a viable investment vehicle, those investments could really take off," said Theodos, who co-authored a recent report on

When real estate prices plummeted during the housing crisis, equity sharing programs fell out of favor with homebuyers and investors. The

The volume of conforming equity-sharing loans has been light so far, but interest in the product is growing now that the rises in home prices and interest rates are outpacing consumers' paychecks in many areas.

"This is a great product for a purchase market and it could be a great product for a first-time homebuyer who is faced with affordability challenges," said David Battany, executive vice president of capital markets at Guild Mortgage Co. in San Diego.

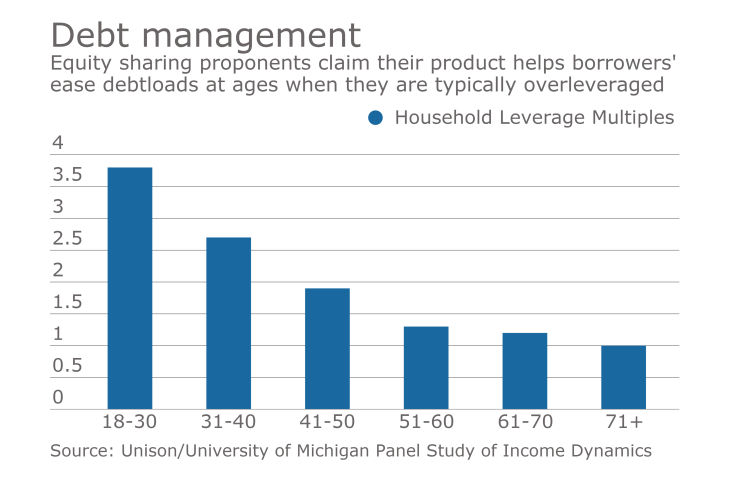

Equity sharing also reduces the upfront financial obligation borrowers would otherwise take on if they used other forms of down payment assistance. That can help borrowers because consumers historically become less leveraged as they age, according to a Unison analysis of University of Michigan data.

"You're not making a monthly payment but what you are doing is sharing the profit from the investment when you sell the house," said Battany.

Government products tend to have risker credit profiles than Freddie Mac loans. The appropriateness of some forms of down-payment assistance have been questioned, notably a state-bond funded down-payment assistance that has been used in conjunction

Private equity sharing is gaining the most traction with prime credit borrowers buying homogenous properties with measureable values in eligible areas. "It's a major portion of the sales presentation in the markets where it's available," said Joe McCone, executive vice president at national mortgage lender First Cal in Petaluma, Calif.

First Cal offers loans with down payments partially funded by Unison in Arizona, California, Oregon, Washington and Maryland, he said. Unison is licensed to offer the product in a limited but growing number of states.

While various forms of equity sharing have existed for decades, the lack of standardization and limited use over time has ensured a lack of broad consumer or lender familiarity.

In the case of Unison, the company handles most of the explanation itself and is quick to determine if the property qualifies through an electronic portal, but the education process still can have an impact on origination time.

But extra time is necessary, given past consumer complaints about inadequate explanations of previous iterations of equity sharing products.

Among lenders' and servicers' considerations in equity sharing is the fact that the investor's stake generally has to be bought out if the borrower wants to pursue a cash-out refinance. Equity sharing investors also typically have a subordinate property lien.

Private equity sharing programs are attractive to investors because real estate appreciation statistics demonstrate it has attractive returns. But equity-sharing providers must invest up front in the equity of the properties and sustain their programs for years before they see a return on their investments, and then only if there's appreciation. At least one equity sharing company

Such risks are outside the government-sponsored enterprises' and lenders' respective bailiwicks and among the reasons why they generally prefer third-party involvement. Unison has large capital commitments from institutional investors for 30 years, said Riccitelli.

"Our business model assumes long-term investments with no payments to the investor during the time that the homeowner lives in the home," he said.