Even as some observers are hedging their views on

However, the government-sponsored enterprise did push out the start date a little farther out to include both the fourth quarter and the first quarter of next year.

"The Fed's policy tightening in an effort to quell inflation is probably close to finished, although their guidance is really more current than forward, and incoming data will be determinant," said Doug Duncan, Fannie Mae's chief economist, said in a press release. "The decline in headline inflation is encouraging, but year-over-year measures will work against further progress in the second half of 2023."

Fannie Mae increased its fourth quarter gross domestic product forecast to call for 1.1% year-over-year growth, up from 0.1%, as previously released first quarter data was upwardly revised.

Still, Duncan

"Putting aside any temporary volatility, we expect mortgage rates to stay higher as well," Duncan said. "While spreads have come in a bit recently, they remain well above longer-term levels and that means rates for consumers will likely stay elevated."

The market is still affected by the

"As we noted in

As the economy slows, the pace of home price growth should also decelerate. Another impact on prices will be

Meanwhile, the benchmark 10-year Treasury, one of the factors in pricing 30-year fixed rate mortgages, has dropped significantly in the past week-plus After hitting an intraday high of 4.09% on July 10, it closed 30 basis points lower at 3.79% on July 18.

The Mortgage Bankers Association's latest Weekly Application Survey reported

"Putting aside any temporary volatility, we expect mortgage rates to stay higher as well," Duncan said. "While spreads have come in a bit recently, they remain well above longer-term levels and that means rates for consumers will likely stay elevated."

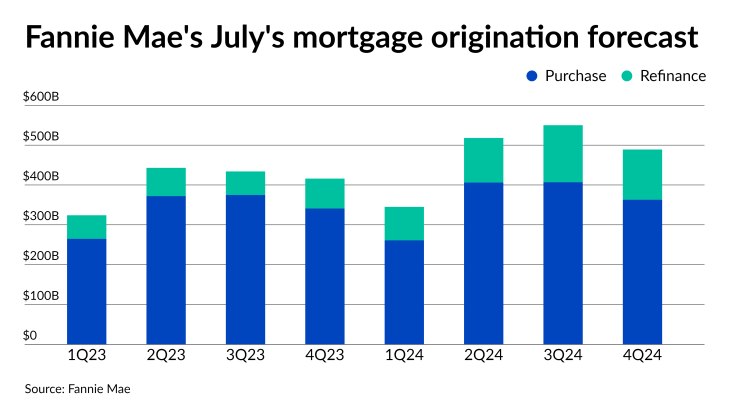

Yet Duncan raised his 2023 forecast for mortgage originations to $1.617 trillion

His prediction of $264 billion for refinance volume was down from $270 billion one month prior.

Fannie Mae's 2024 prediction for total production of over $1.9 trillion was virtually unchanged, but July's purchase forecast of $1.437 trillion was $29 billion higher than the prior month. That was offset by a $28 billion cut in the refi forecast to $465 billion.

Duncan doesn't expect the average for the 30-year FRM to go back below 6% until the second quarter of next year. The Mortgage Bankers Association's June forecast called for