As vaccination rates climb and restrictions lift, the economy’s rebound should continue into the summer, but

While the government-sponsored enterprise’s May forecast predicts 6.3% growth in the number of home sales to 6.87 million in 2021 from 6.46 million in 2020, it would be even higher if there were more inventory, given the

“Stronger inflation and a resultant move in interest rates are risks that we believe should be monitored,” Duncan said in a press release. “This could

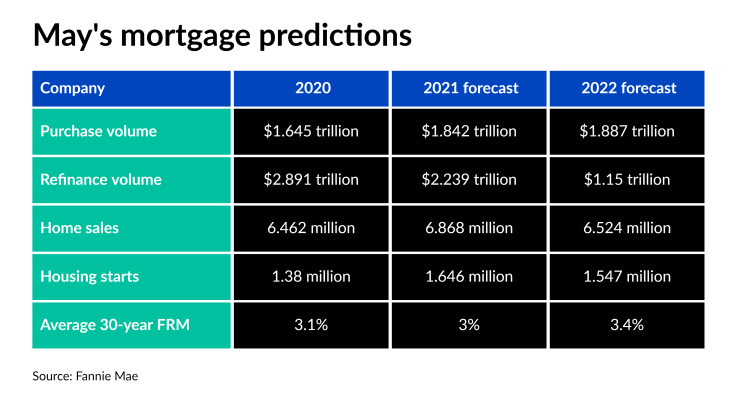

After a record $4.54 trillion in origination volume in 2020, Fannie anticipates that number to fall to $4.1 trillion in 2021 and $3.04 trillion in 2022. Refinance totals are expected to bring down the overall volume, dropping to $2.24 trillion in 2021 and $1.15 trillion in 2022 from 2020’s $2.89 trillion. Fannie projects purchases to steadily increase, rising to $1.84 trillion in 2021 and $1.89 trillion in 2022 from $1.65 trillion in 2020.

The steep decline in refis comes with