The Federal Housing Administration has implemented defect taxonomy revisions for 2020 that it considers one of several milestone achievements in its efforts to "provide greater clarity and consistency for lenders.”

The move is among several FHA officials laid out plans for at the

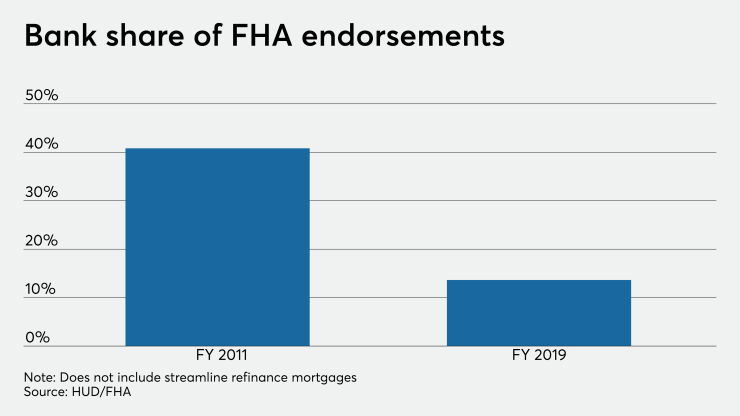

Banks retreated from the sector after large penalties related to allegations of improper FHA lending were levied in the wake of the financial crisis. The latest revisions to the taxonomy used to classify and define loan errors are aimed at giving lenders more certainty about the bounds they need to operate in to avoid liability.

There historically have been high levels of liability associated with False Claims Act violations, which HUD and the Department of Justice used to pursue lenders that allegedly produced problematic FHA loans. Courts can award three times the amount of actual or compensatory damages for these violations under the False Claims Act.

In the 2020 revision of its 2015 defect taxonomy, among the error classifications the FHA worked to clarify were the bounds of different severity tiers it has for errors, and what some potential remedies for errors are in different severity tiers.

Other steps taken to address lenders’ liability concerns include a