-

The unusual nature of a recent lawsuit from the Department of Justice has put a multi-billion-dollar industry in the position of deciding either to violate federal law or run afoul of the DOJ, writes the former Chief Legal Officer of Research In Motion Ltd.

November 25

-

In a complaint filed by the Justice Department on Friday, antitrust enforcers said RealPage's software, which helps landlords set rental unit pricing, has effectively raised prices on renters illegally.

August 23 -

In late July, the Justice Department notified the Houston bank of a potential lawsuit alleging violations between 2013 and 2017, according to a securities filing. Cadence said that its prospective merger partner, BancorpSouth, supports the settlement discussions.

August 2 -

The department's antitrust division said Thursday that it was withdrawing from the November 2020 agreement because its terms prevent the division from continuing to investigate association rules that may harm homebuyers and sellers.

July 2 -

The Michigan lender agreed in 2012 to pay $133 million to resolve civil fraud charges tied to government-backed mortgages. But the deal with the Justice Department came with a catch that eventually allowed Flagstar to pay far less.

April 15 -

The three companies agreed to pay a total of $74 million in remediation.

December 7 -

If the underwriters' option is exercised, proceeds will bring in $112 million instead of a possible $176 million.

October 22 -

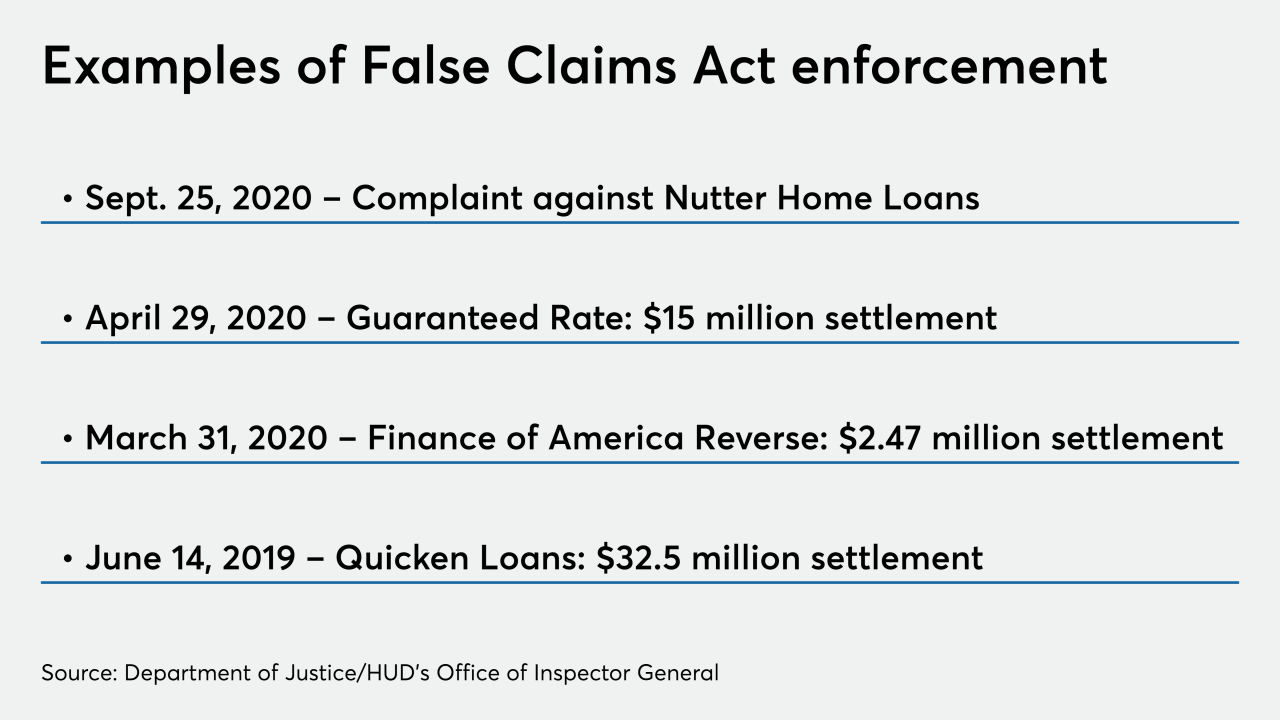

The accusations against Nutter Home Loans, like an earlier settlement with the Department of Housing and Urban Development, center on concerns related to FHA-insured reverse mortgages. The company "strongly disputes" them.

September 30 -

Through Operation Corrupt Collector, the bureau is coordinating with over 50 other state and federal agencies to target firms for wrongdoing and inform consumers of their rights

September 29 -

Citing possible exploitation, Bank of America instituted a policy that put limits on loans to persons in guardianship. It later ended the policy.

July 24 -

Finance of America Reverse agreed to pay $2.5 million to settle allegations that a company it acquired violated the False Claims Act for loans submitted for Federal Housing Administration insurance in 2010.

April 2 -

The company disclosed that an internal review of a now-discontinued loan program found that employees engaged in misconduct tied to income verification and requirements, among other things.

March 9 -

The 10-digit penalty marks an important milestone for the bank, but individual ex-bankers may still be at risk and grueling hearings lie ahead for current leadership.

February 21 -

A deferred-prosecution agreement with the Justice Department spares the bank a potential criminal conviction — provided it cooperates with continuing probes and abides by other conditions.

February 21 -

A former Fannie Mae employee is facing more than six years in federal prison for participating in a scam involving discount sales of properties owned by the government-sponsored enterprise.

January 15 -

The fact that the more operationally skilled nonbanks have come to specialize in government mortgages is hardly surprising if you assess the cost to originate and service these loans.

January 13 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Stephen Calk and the bank where he formerly served as CEO are both arguing that his bribery trial should be held in Illinois. Prosecutors oppose the move.

January 13 -

The Federal Housing Administration has implemented defect taxonomy revisions for 2020 that it considers one of several milestone achievements in its efforts to "provide greater clarity and consistency for lenders.”

January 3 -

The mayor of Taylor, Mich., was indicted by a federal grand jury on allegations of bribery related to the sale of tax-foreclosed properties

December 20 -

Stephen Calk, who faces a bribery charge in connection with loans his bank made to former Trump campaign chair Paul Manafort, is asking a judge to suppress evidence that prosecutors obtained from his mobile phone.

November 18