WASHINGTON — The Federal Housing Administration is urging mortgage servicers to provide leniency to federal workers affected by the government shutdown who are struggling with mortgage payments.

FHA Commissioner Brian Montgomery

In particular, the FHA expects servicers to extend special forbearance plans to borrowers impacted by the shutdown and evaluate borrowers for loss-mitigation options to prevent foreclosure. Montgomery also advised servicers to waive late fees and suspend credit reporting for affected government workers.

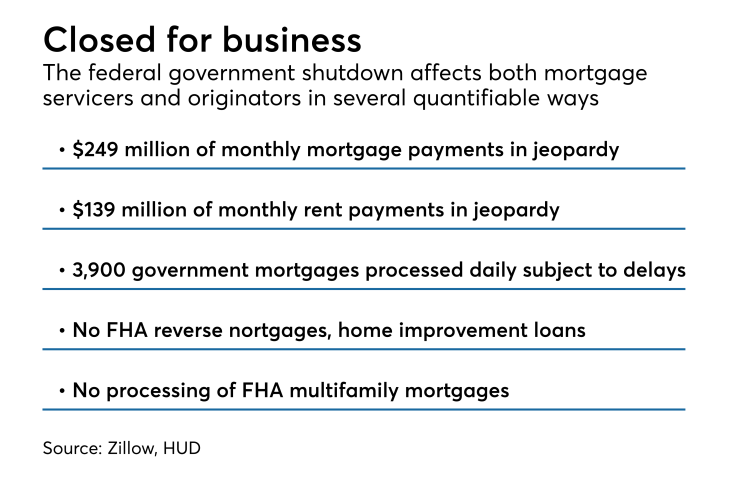

An estimated

Many mortgage servicers are already operating forbearance plans normally used in the

The shutdown affects nearly 800,000 government employees. About 420,000 are currently working without pay and 380,000 are furloughed and not working at all.