The government shutdown is not just affecting federal agency employees' ability to make their mortgage or rent payments, it could take them out of the home buying market, Zillow said.

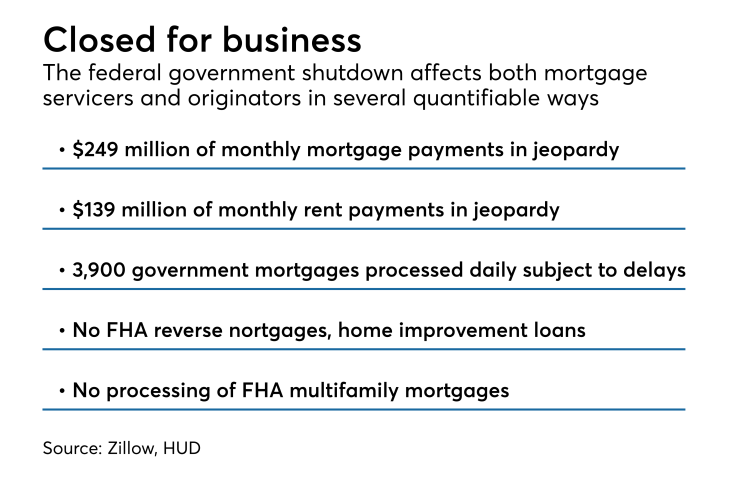

There is an estimated $249 million of monthly residential mortgage payments that are in danger of not being paid as a result of

While some mortgage servicers, as well as the government-sponsored enterprises are putting plans similar to those

Rental property owners will see their cash flow affected as well. Affected federal employees pay $189 million in rent each month, according to an analysis from Zillow subsidiary HotPads, funds landlords rely on to pay their loans.

"Like Americans in the private sector, many federal employees rely on each and every paycheck to cover critical expenses, including housing," Aaron Terrazas, Zillow's senior economist, said in a press release. "In many parts of the country, housing affordability is already stretched and a single missed payment can begin the long process toward foreclosure or eviction — which has long-term impacts on an individual's finances and long-term economic prospects."

Furthermore, as a result of the shutdown, endorsements for federally guaranteed mortgage loans like the Federal Housing Administration program and Rural Housing Service are being delayed. The FHA

There are approximately 3,900 mortgage originations processed daily by federal agencies that are now operating with limited staff, with as many as 39,000 loans affected as of Jan. 8, Zillow estimated. No reverse mortgages or home improvement loans are being endorsed by FHA during the shutdown.

The shutdown could also scare federal workers who are potential homebuyers out of the market, Terrazas said.

"It also could have a significant impact on the overall housing market if it continues to drag on and furloughed workers who also are would-be buyers get cold feet in the absence of paychecks. Buying a home is a huge leap of faith for many, as they bet on continued job security and steady income to finance their home, and consumer confidence is paramount," he said.

The shutdown is also affecting the FHA multifamily lending program.

During the first 30 days of the shutdown, the FHA will allow closings for properties that had an initial endorsement with a firm commitment issued on or prior to Dec. 21, 2018, according to a Department of Housing and Urban Development memo issued on Jan. 4.

However, no new applications for multifamily mortgage insurance will be accepted or processed and no change orders will be processed or approved, the memo said.

FHA Multifamily Accelerated Processing program lenders servicing construction loan and administering noncritical repair escrows, at their and the property owner's and general contractor's risk, can process interim construction draws.

Contract construction inspections which have been funded will be conducted. HUD will perform or review construction inspections on a post-review basis when the shutdown ends.

In a separate memo, multifamily property owners with FHA-insured mortgages may submit requests for relief from their reserve for replacement accounts to cover any funding shortfalls caused by the nonpayment of a monthly rental subsidy.