Finance of America Reverse has launched a revolving credit line product that allows borrowing power to increase over time by allowing 75% of funds to grow for future use.

"The bigger line of credit option is a major development for seniors," Dan Hultquist, vice president of organizational development at the company, said in a press release. "They now have the peace of mind that a line of credit can provide, without the burden of a required monthly principal and interest payment."

The company also recently lowered the minimum age requirement for its proprietary reverse mortgages to 60. The Federal Housing Administration's Home Equity Conversion Mortgage program, which dominates the reverse mortgage market, requires borrowers to be at least 62 to participate.

A growing number of lenders in the reverse mortgage market have been broadening their product lines beyond the parameters of the FHA's program. Plaza Home Loans, for example, launched a jumbo reverse mortgage up to $4 million.

Finance of America was the third-largest HECM lender based on 12-month endorsements through October, according to New View Advisors.

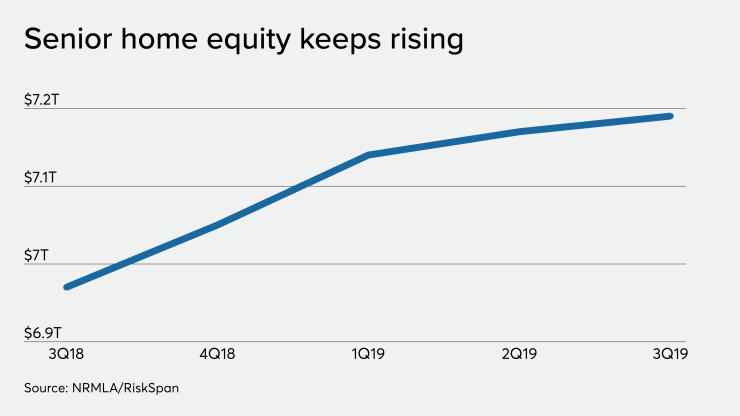

Housing wealth held by senior borrowers rose 0.3% or $24 billion month-over-month to an all-time high of $7.19 trillion in the third quarter, according to an index that the National Reverse Mortgage Lenders Association and RiskSpan produce.

The latest consecutive-month increase in senior home equity stemmed primarily from a 0.5% or nearly $41 billion increase in the value of homes owned by those age 62 and up. There also was an offsetting 1% or more than $16 billion increase in senior-held mortgage debt in the third quarter.

Senior home equity has risen to varying degrees on a month-to-month basis since the second quarter of 2011.