After a 20%

Foreclosure filings — inclusive of default notices, bank repossessions and scheduled auctions — totaled 10,042, down from 11,673 month-over-month from and 49,898 year-over-year.

One in every 13,581 mortgaged properties sat in a stage of the foreclosure process in November. Florida led the nation with the highest foreclosure ratio with one in every 7,109 units. Illinois fell close behind at one in 7,285, then came Oklahoma's one in 8,128.

St. Louis had the highest rate for housing markets with populations above 1 million at one in every 1,993 properties. Cleveland followed, at one in 5,368, with Jacksonville, Fla., third at one in 5,877 units.

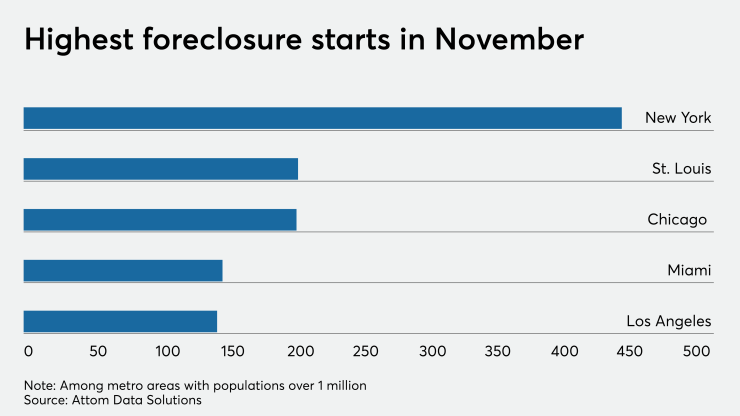

"It's not unusual to see foreclosure activity slow down beginning in November and through the holiday season," Rick Sharga, executive vice president at RealtyTrac, said in the report. "Both foreclosure starts and repossessions were down about 80% on a year-over-year basis, but it might be worth noting that a few cities that may be vulnerable to the pandemic-driven flight from urban areas to the suburbs — like New York City, Chicago, and Miami — were among the markets with the highest levels of foreclosure actions."

Foreclosure starts mirrored filings, declining 13% from October and 79% from November 2019. Overall, 5,256 units started the foreclosure process, compared to 6,042 and 24,966 the month and year before, respectively. The amount of starts grew by 18% in Missouri, 14% in Indiana, 4% in Georgia and 1% in both Arizona and Texas.

Among metro areas with over 1 million people, New York led with 454 foreclosure starts, followed by 208 in St. Louis, 207 in Chicago, 151 in Miami and 147 in Los Angeles.

Lender foreclosures dropped 22% monthly and 86% annually. Bank repossessions compiled 2,010 properties in November from 2,577 in October and 13,996 a year prior. Florida filed the most REOs with 273, followed by 167 in Illinois and 164 in California. Chicago led all large housing markets with 114, trailed by 93 in Phoenix and 88 in Atlanta.