While foreclosure numbers treaded near historic lows, blanketed by

Foreclosure filings — inclusive of default notices, bank repossessions and scheduled auctions — totaled 10,821 in May,

Even though the annual growth in both categories marked the first in the moratorium period, the overall figures are still relatively small, explained Rick Sharga, executive vice president of Attom's consumer-facing business, RealtyTrac.

“While the increase in foreclosure activity is significant, it’s important to keep these numbers in perspective,” Sharga said in the report. “Last year’s numbers were extraordinarily low due to the implementation of the foreclosure moratorium and the

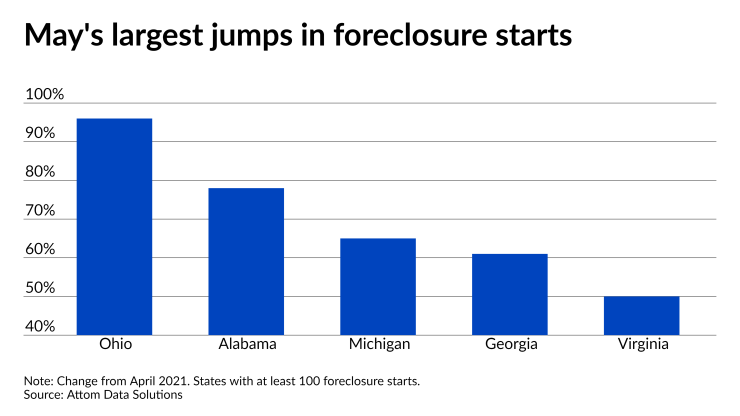

Many states

One in every 12,700 U.S. mortgaged properties sat in a stage of the foreclosure process in May, compared to one in every 11,636 in April and 15,556 the year before. Nevada usurped the highest foreclosure rate at one in every 5,535 units. Delaware fell to second at one in every 5,854 units, followed by Illinois at one in 5,903.

Broken down by metro areas with populations above 200,000, Champaign, Ill., had the highest foreclosure rate at one in every 2,420 units. Next came only a few hours away in Peoria, Ill., at one in every 3,030, followed by Cleveland’s one in every 3,715.

Lender repossessions dropped 15% monthly and plummeted 54% yearly with a total of 1,315 properties completing the foreclosure process in May. California had the most REOs for the month with 154, trailed by 148 in Florida and 144 in Illinois.