Home equity lines of credit are on track to become a hot product over the next five years.

"We're expecting double the originations, and I think that's significant," said Joe Mellman, a senior vice president who oversees the mortgage business line at TransUnion.

That's a contrast to earlier takes on the HELOC market that suggested it hasn't been that active outside

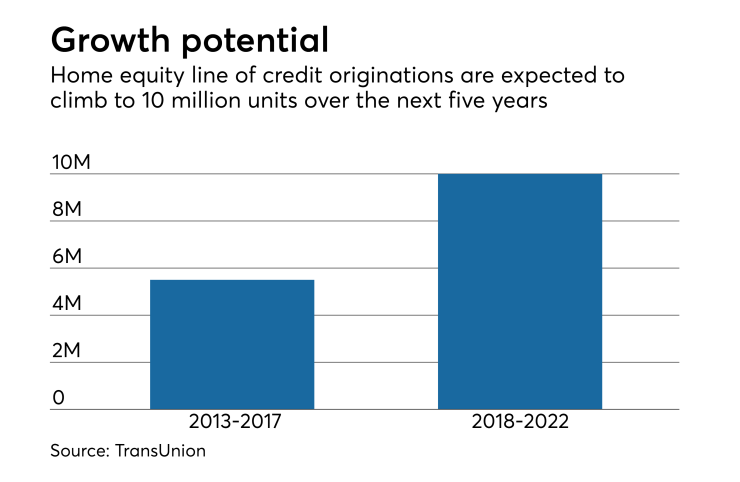

The number of HELOCs outstanding is still low relative to the housing boom, but unit originations of HELOCs are in position to grow fast enough to total 10 million over the five-year period ending in 2022.

That's almost twice the estimated total of 5.5 million for the five-year period ending in 2017.

"Like all tipping points I don't necessarily think it is one thing," Mellman said, when asked why growth prospects for HELOCs are looking stronger.

"First of all, there's time to reflect and see this massive tightening from 2009 and be thoughtful about loosening up," he said.

There were 5 million HELOCs originated in 2005. The high end of estimates for annual originations by 2022 is 3 million, which sounds low relative to the peak of the housing bubble, but represents a significant increase compared to the 1.2 million in HELOC originations seen in 2016, Mellman said.

"I'm not saying we should or will see the same volume as the bubble. We're not getting to the heights of 2005, but we're still going to see significant growth from where we've been," he said.

In addition to lenders' increased comfort with slightly looser HELOC underwriting, the recent rise in short-term rates also is contributing to increased demand for HELOC production. HELOCs have attractive rates compared to other consumer debt like auto loans or credit cards.

But "the biggest factor is we've just had a huge increase in home equity and people have not been tapping that home equity," Mellman said.

For a while in the post-crisis era, fintech lenders that provided unsecured personal lending filled the gap created by the drawback in home equity lending, "but I think we're now going to see a little rebalancing of that," said Mellman. "I think we're going to see lenders coming back into the HELOC space."