The coronavirus put a damper on the spring home-buying season and constrained inventory — both in construction and property listings — but one corner of the market is showing signs of improvement. While a lack of supply remains a

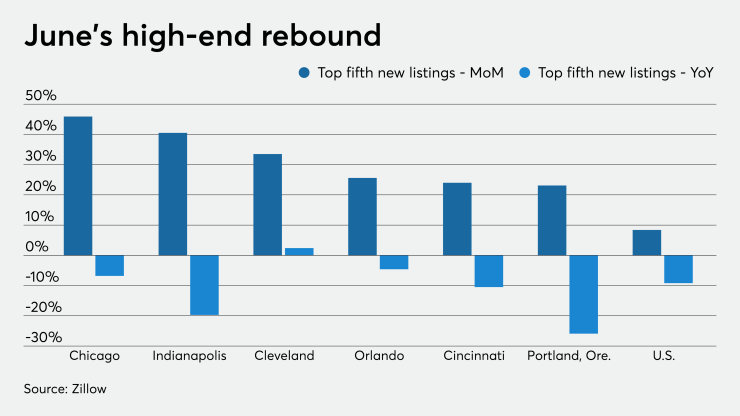

The top fifth of listings by price jumped 8.4% in June from May and only trail year-ago totals by 9.2%. The bottom fifth saw a 9.3% decline in listings in June from May and 29.2% drop year-over-year. Median list prices jumped 2.9% month-over-month to $337,160 because of this disparity.

"The way

"Millions of Americans who lost jobs or income are only able to stay in their homes right now thanks to

From May to June, Chicago led the way with a 45.9% surge in top fifth listings, followed by 40.5% in Indianapolis and 33.5% in Cleveland. Only three of the top 35 metro areas posted declines in this segment, with drops of 15.6% in Pittsburgh, 5.9% in Riverside, Calif., and 1.8% in Austin, Texas.

"For wealthier homeowners whose employment has remained stable and are looking to trade up, now may be an opportune time to sell and lock in a

A dozen of the 35 largest metros had monthly listing gains for the bottom fifth of the market. Cincinnati's 19.2% bested 18.4% in Las Vegas, while Minneapolis trailed with 15.3%. Conversely, bottom fifth inventory fell by 40.8% in Pittsburgh, 39.5% in Indianapolis and 35.4% in Phoenix.

Although only a small portion of housing bounced back thus far, it falls in line with Fannie Mae's latest Home Purchase Sentiment Index, which found buyer and seller consumer outlooks improved in June, rising from