Home prices moderated in the fourth quarter of 2021, slowing from the record pace set earlier in the year, but remaining well above historical norms, the Federal Housing Finance Agency found.

The FHFA’s quarterly Home Price Index jumped 17.5% in the final three months of 2021 compared to the same quarterly period one year earlier. While the spike was one of the largest annual jumps in the index’s history, the rising pace slowed from 18.6% and 17.8% in the two prior quarters.

Housing markets have appreciated on an annual basis in the fourth quarter every year since 2012, according to the FHFA. The increase in the final three months of 2020 came in at 11.1%. On a quarterly basis, home prices nationwide rose by 3.3%, and by 1.2% month-over-month in December, seasonally adjusted. The agency’s HPI is determined by measuring average price changes in repeat sales or refinancings on the same properties using seasonally adjusted, purchase-only data from Fannie Mae and Freddie Mac.

The rate of price growth is likely to moderate even further if current trends persist, said William Doerner, supervisory economist in FHFA’s division of research and statistics.

“The quick house price gains may be counterbalanced as mortgage rates increase,” said Doerner said in a press release.” Since the beginning of the year, the 30-year fixed-rate mortgage has

“However, more expensive housing has elevated affordability to become a broader concern as available supply remains limited,” Doerner cautioned.

Recent

“Rising rates may negatively impact both housing affordability and supply, but it may also result in a housing market rebalancing” Fleming said in a press release.

“Double-digit nominal house price growth in combination with rising rates is likely to cause some buyers to pull back from the market, resulting in fewer and less intense bidding wars and, ultimately, a moderation in-house price growth.”

The shortage of available homes for sale helped push average purchase mortgage sizes to new record highs for

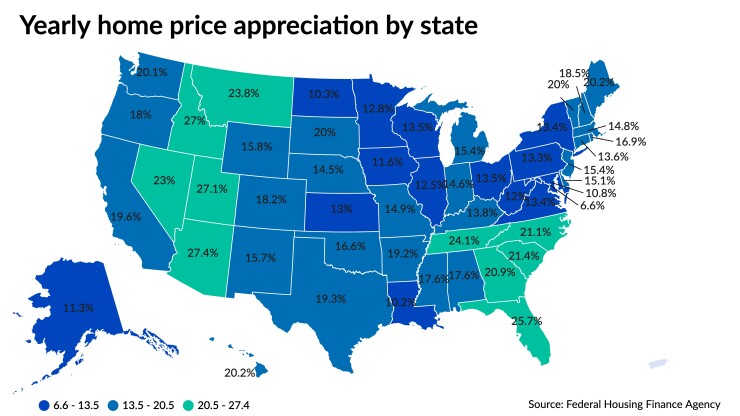

In the FHFA’s index, researchers found home prices increasing in every state and the District of Columbia on a year-over-year basis in the fourth quarter of 2021, from a range of 6.6% in the nation’s capital to 27.4% in Arizona. Just behind Arizona was Utah, where prices climbed by 27.1% and Idaho, which saw a 27% increase. The Southeastern states of Florida and Tennessee rounded out the top of the list, with home-price appreciation coming in at 25.6% and 24.1%.

The Mountain region, consisting of Arizona, Colorado, Idaho, Montana, Nevada, Nex Mexico, Utah and Wyoming, outpaced the country’s eight other census divisions in price appreciation with a pace of 23.6%.

On the opposite end, ahead of the District of Columbia, home prices climbed by the smallest percentage in Louisiana with 10.2%, North Dakota at 10.3%, Maryland with 10.8% and Alaska at 11.3%. Among census divisions, the West North Central experienced the least amount of growth at 13.6%.