Homebuyers saving for a down payment contributed to the slowest rate of August price appreciation in nearly two years; and the market could have even less momentum by next summer.

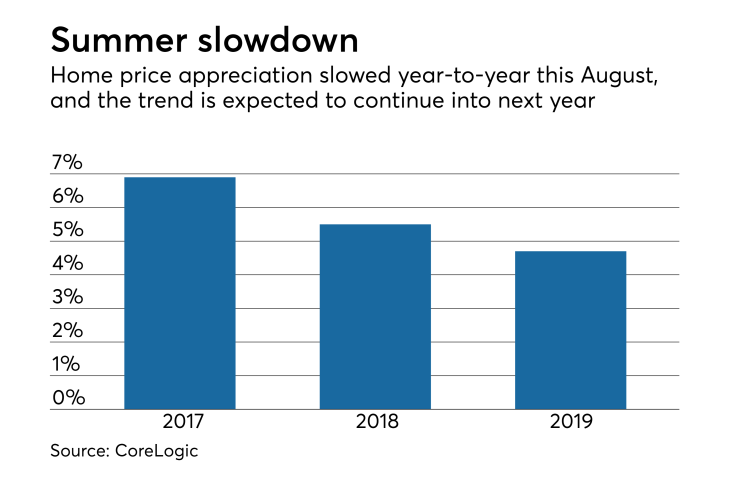

Nationally, appreciation was up 5.5% from the same month a year ago and by next August it is expected to be increasing at a rate of just 4.7% year-over-year, according to CoreLogic's home price index.

"In some markets, homebuyers and sellers are remaining cautious and taking a pause as price appreciation continues to rise," Frank Martell, president and CEO of CoreLogic, said in a press release. "By waiting to sell, homeowners believe they will get the greater return on their investment; the more money they have for a down payment, the easier the purchase payments will be for their next year."

Delays by borrowers who are saving for down payments in order to make homes more affordable contribute to a larger reduction in home buying activity.

"The rise in mortgage rates this summer to their highest level of seven years has made it more difficult for potential buyers to afford a home," CoreLogic Chief Economist Frank Nothaft said in the press release. "The slackening in demand is reflected in the slowing of national appreciation."

While home price appreciation was slower in August on a year-over-year basis, it inched up 0.1%

Home purchases and price appreciation tend to slow in the fall because borrowers with children prefer to complete their moves before the start of the school year.