A consumer's home purchase power declined in December on a year-over-year basis for the first time in more than two years as a result of higher interest rates in the aftermath of the November elections.

Home prices, when adjusted for income and interest rate movements, were up by 8% year-over-over and 6.2% over November, according to First American Financial Corp.

As a result, consumer purchasing power fell 2.1% in December when compared with the same month in 2015 and by 5.1% from November.

"December [was] the first full month to see the impact of the surge in mortgage rates after the election and the most recent Federal Open Markets Committee rate increase. This interest rate surge lead to the first year-over-year decline in consumer house-buying power in two and a half years," said First American Chief Economist Mark Fleming said in a press release.

"Wages grew at a brisk annual rate of 2.9% in December, the largest increase since 2009, which was beneficial for housing affordability, but not enough to offset the impact of rising rates," he added.

On an unadjusted basis, home prices are 5.8% higher when compared with December 2015 and they are now 1.5% higher than the peak of the boom in 2007. But using First American's adjusted measure, they are down 33.1% from July 2006.

"Rising rates and nominal home price growth are outpacing the influence of strong income growth, leading to declining affordability for first-time home buyers. However, housing remains as affordable as it was in late 2009," Fleming said.

-

While federal examination and investigative activity has all but stopped, the regulator is still providing regulatory guidance to the industry.

2h ago -

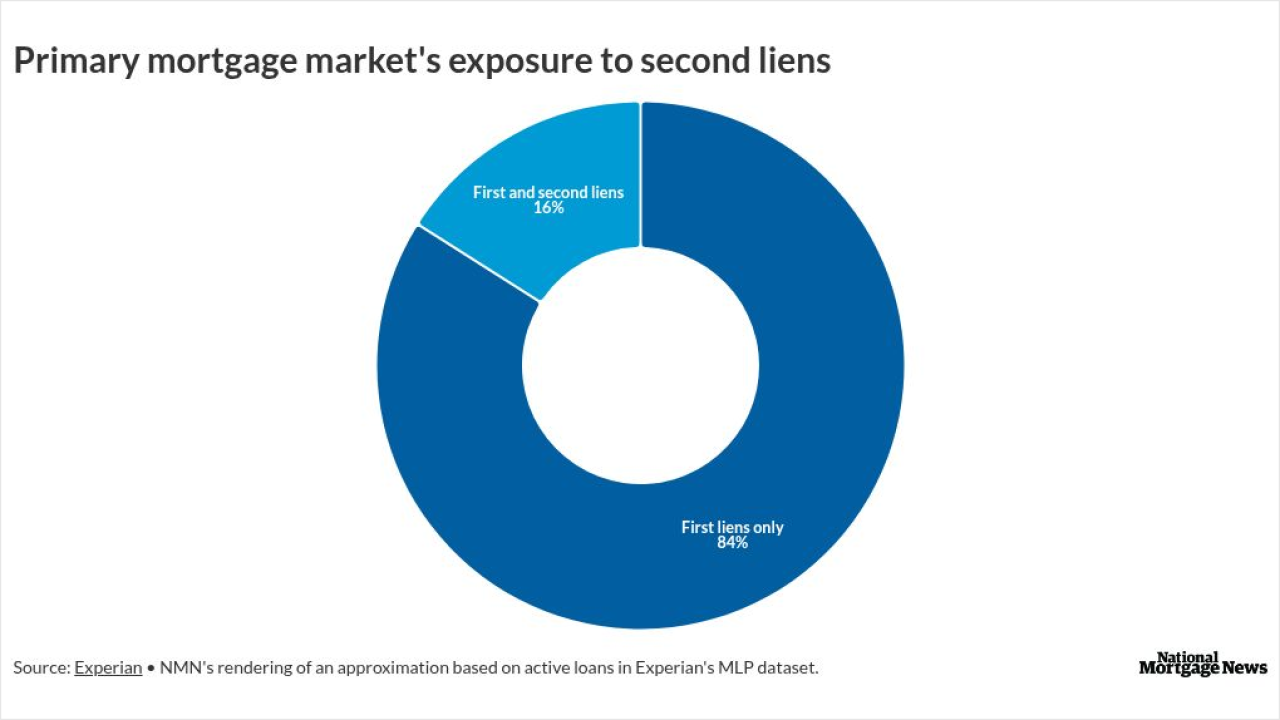

Agency MBS investors have had limited information about primary loans coexisting with home equity products, and may want to get more now, according to Experian.

March 11 -

A near-record share of homeowners unable to sell their properties are renting them out instead, with "accidental landlords" accounting for 2.3% of listed rental stock in October, per Zillow data.

March 11 -

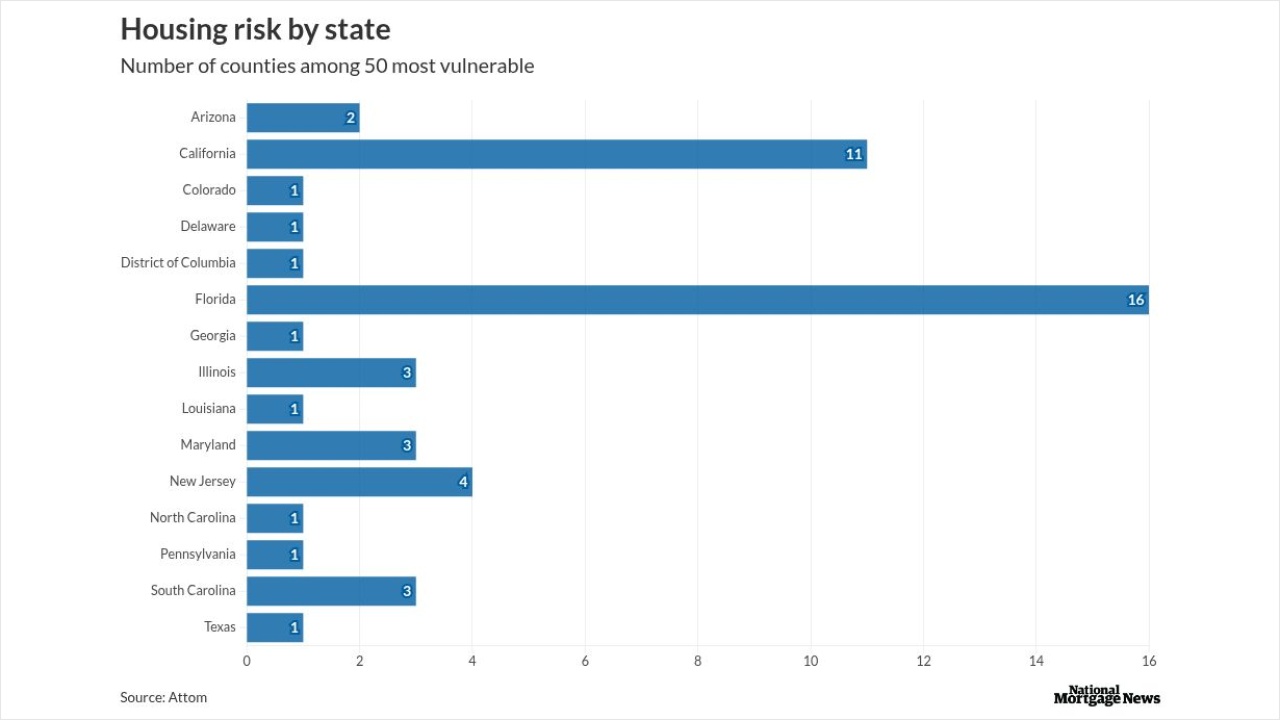

Residents in more than half of U.S. counties need greater than one-third of income to successfully manage major housing costs, according to new Attom research.

March 11 -

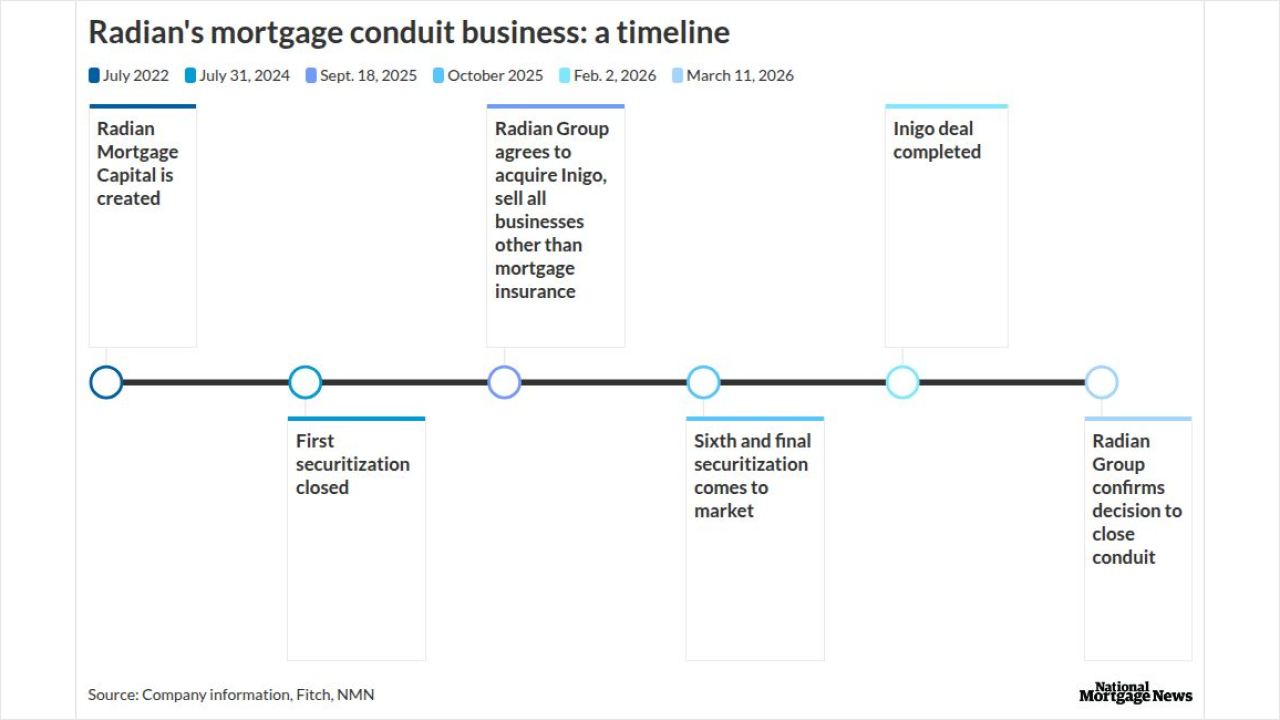

Radian Group was looking to sell the aggregator, along with its title and real estate units, following a business model pivot related to the Inigo buy.

March 11 -

Some of the best mortgage companies to work for discuss how they incorporate community service in their plans and the resulting business and personnel benefits.

March 11