Homebuyers with good credit would be able to get a Federal Housing Administration insured mortgage with no upfront insurance premium under a legislation proposal the Department of Housing and Urban Development is finalizing.The legislation will allow FHA to offer risk-based premiums so that it can both serve and attract borrowers with high credit scores as well as subprime borrowers. Based on their credit score and loan-to-value ratio, creditworthy borrowers would only have to pay a 50 basis point annual insurance premium on FHA loans. For subprime borrowers, FHA could charge a maximum 3% upfront premium and a 75 bp annual premium. "This would provide an option to potential homebuyers who have no choice right now except to go to subprime lenders," HUD secretary Alphonso Jackson said. FHA is a "cheaper" and a safer option, the secretary added.

-

The Federal Housing Finance Agency said it is reviewing more than 9,000 pages of records tied to fraud tips submitted through a hotline launched last April.

49m ago -

The agreement between servicing technology platform Vertyx and Great Lakes Credit Union arrives as the mortgage industry sets its focus on borrower retention.

1h ago -

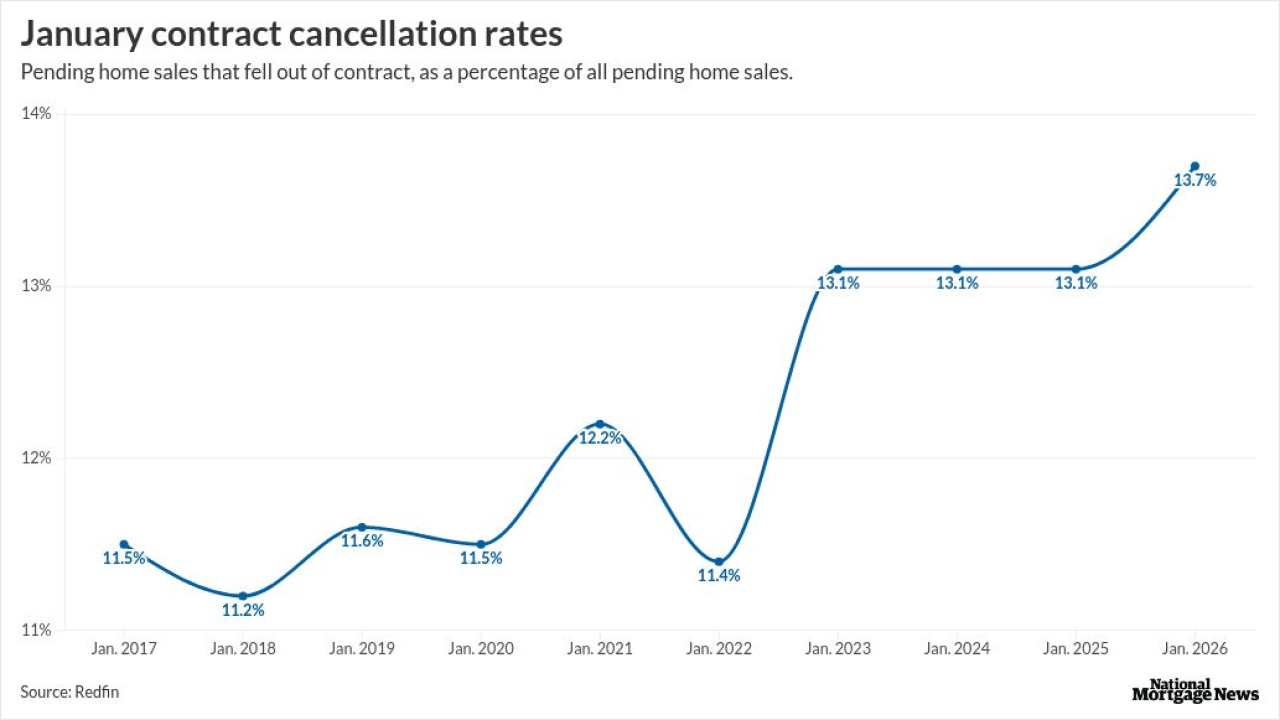

Nearly 14% of homes that went under contract last month were cancelled, up from 13.1% last year and the highest January share in records, according to Redfin.

2h ago -

Federal Reserve Gov. Lisa Cook said AI could boost productivity, but warned the transition may raise unemployment and force difficult tradeoffs between inflation and jobs.

3h ago -

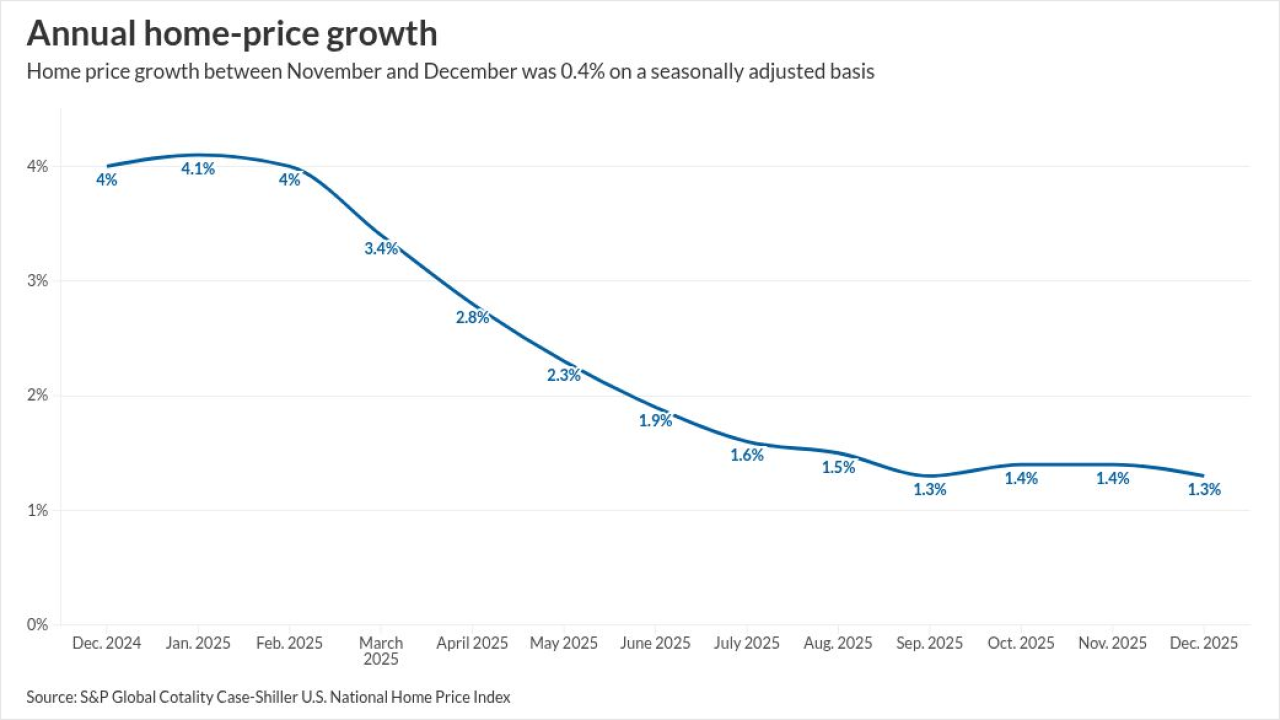

Home prices edged up nationwide, but gains were modest and uneven. Major indexes agree on direction, differ on size, as 2025 posted weak growth.

6h ago -

Federal Deposit Insurance Corp. report shows margins widened and profitability remained high even as credit quality saw some wobbles from consumer and commercial loan portfolios.

6h ago