Economic optimism fueled a rise in mortgage credit availability for the second time in a year last month, when offers of

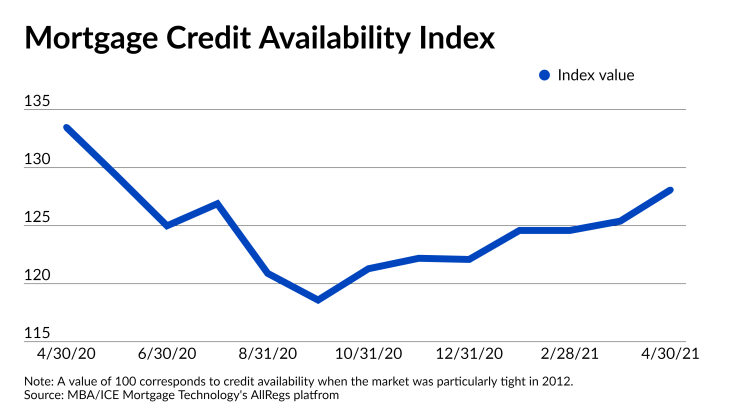

A Mortgage Bankers Association index that measures credit availability based on the number and breadth of lenders’ loan programs climbed to 128.1 in April from 125.4

The improvement in the MBA’s index suggests that lenders are confident enough in the recovery from the pandemic and the U.S. vaccine rollout to make an increasingly broad range of loans, but haven’t loosened underwriting to any worrisome degree, such as was seen during the Great Recession’s housing crash. The index is still near its historic low of 100.

“The news, for the most part, has been better, and we are certainly seeing household financial health has improved,” Joel Kan, associate vice president of economic and industry forecasting at the MBA, in an interview.

Part of the increased credit availability in the mortgage market stems from the fact that lenders have more bandwidth to offer multiple loan programs now that they aren’t scrambling as much to keep up with record volume of refinancing, he said.

Lenders have been particularly active in offering government-sponsored enterprise loans for low- to moderate-income buyers. Credit availability for these loans, which are purchased by Fannie Mae and Freddie Mac, rose 12.6% in April.

Agency loans lenders offered more aggressively in the past month included hybrid adjustable-rate mortgages that have fixed rates for five-years and adjust thereafter, said Kan. While the share of ARMs in the market remains low, it has generally trended upward in recent months, he said.

Hybrid adjustable-rate mortgages have been priced at more attractive rates, indicating that lenders are more eager to offer them, said Eli Sklar, a senior loan consultant at loanDepot, in an interview. Generally fixed rates have been in the 3% range and the ARMs have been offered at around 2.5% or so in the past month, he said.

Larger loans that Fannie and Freddie allow in some markets with particularly high home prices also have been gaining traction, Kan said.

Anecdotal evidence suggests it’s continuing to expand this month as well. Plaza Home Loans, for example, released a new jumbo product that allows unpaid principal balances of up to $2 million on Tuesday.

A regulatory change was the catalyst for Plaza’s new product. Voluntary use of a new Qualified Mortgage definition is giving lenders more comfort that a broader range of large loans will meet regulatory requirements even though

Meanwhile, at the other end of the spectrum, lenders aren’t loosening up quite as much when it comes to doling out smaller loans to first-time buyers who use government-insured loan programs. Credit availability available for these loans inched up just 0.1% in the past month.

“That’s always critical for the home-purchase market, so hopefully as we get into the year, that market recovers and we see more growth there as well,” Kan said.

Mortgage professionals generally expect lending parameters to keep broadening so long as recovery from the pandemic keeps going well.

“I think the lenders realize that as much as there were forbearances, the majority of America will have jobs. They’re making enough money to pay their mortgages. The risk of default has really been diminished,” said Sklar.