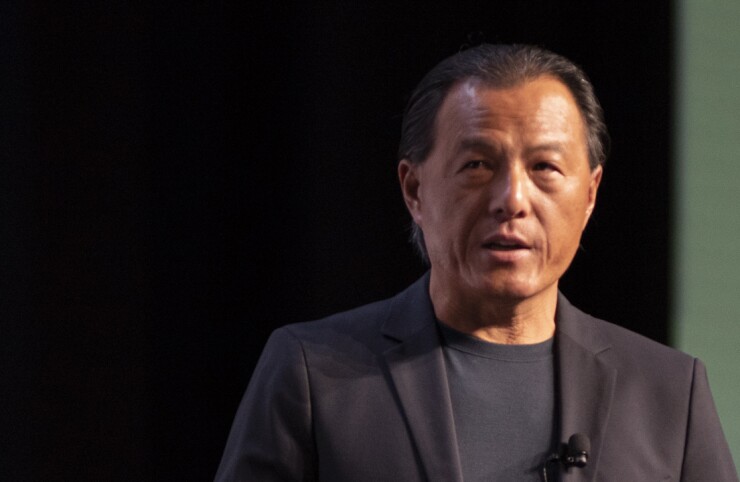

LoanDepot's CEO Anthony Hsieh delivered a bracing message to mortgage lenders on Monday — strong new competitors are coming into this market, so they need to expand their offerings.

"There's some new players in town," Hsieh said at National Mortgage News' Digital Mortgage conference in Las Vegas. "They're way up funnel from us. Many of them are becoming very powerful."

Fintech lender GreenSky, he noted, has a market cap north of $3 billion. Redfin has a mortgage company while Zillow is about to have one. OpenDoor, a real estate purchasing site provider, has acquired Open Listings, a company that automates much of what a Realtor does. OfferPad, an on-demand, tech-enabled direct home buyer and seller, has a mortgage partnership with Hsieh's own loanDepot, the second largest nonbank mortgage lender in the U.S.

And then there's Amazon and Google.

"It's just a matter of time, not a matter of if," those two companies will compete for mortgages, Hsieh said.

"Lots of power there, lots of intellect, and these companies understand digital," Hsieh said. "There's no doubt they're going to widen their products and services. You have big brands making bets to add products and services. You have real estate service and lending companies looking at each other: we're friends. Or will that turn into foe?"

Having a digital mortgage will not be enough for traditional lenders to compete.

"What customers want is a simplified experience; they prefer less brands to get them through that transaction," he said. "They would prefer one brand. But today that does not exist. Many companies will be chasing to answer that question how to delight the customer. Very few will succeed. Lots of capital will be burned trying to satisfy that outcome."

Mortgage lenders in the past have waited for someone, such as a Realtor, to pull them into the home-buying process. That must change, he said.

"Over the last 10 years, the defensiveness from traditional loan officers has always been, 'I provide great service, technology will never replace that,'" he said. "They have it all wrong. Whoever said that was a multiple choice question? It's answer C, all of the above. Customers want the convenience, ease and control they have using technology. They want to be the boss in communications. When they want good service, you'd better be there. Our business is local. Blending digital tools with local, and expert service in our opinion is the formula."