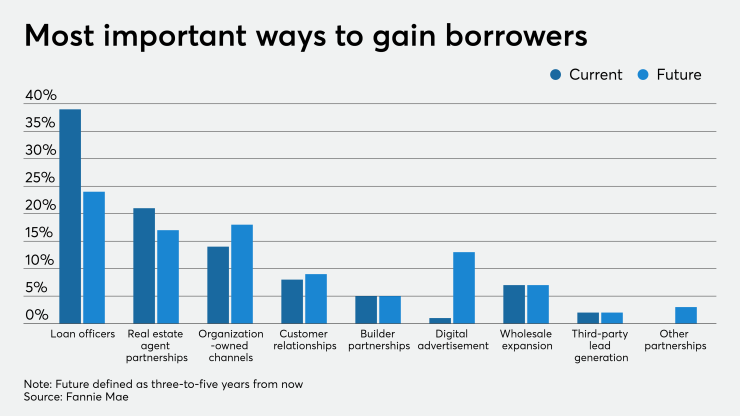

While loan officers will remain mortgage lenders' leading business development tool in the future, those originators believe business will come from a more diversified source pool, a Fannie Mae survey found.

About 39% of industry executives said LOs currently represent their best avenue for gaining new business while 24% said it will be the most important in the next three to five years in

"The growing focus in the mortgage industry on the use of digital tools and data is clear. In a recent study, lenders told us they perceived 'online business-to-consumer lenders' as their biggest competitor over the next five years. Lenders in the current study commented that they wanted to use digital media to expand footprints and customer base," Desmond Smith, senior vice president and chief customer officer at Fannie Mae, said in a blog. "While lenders reportedly are placing more emphasis on leveraging data and digital media for future customer acquisition, the findings of this research and previous studies suggest that they should also take into consideration the

For borrower retention, exuding great customer service was deemed as the top strategy by 52% of executives. An easier origination process received 13% of first-place votes and lower interest rates was third with 12%.

"In a previous study among consumers, when asked about the most 'influential' source of mortgage-related information, consumers told us that industry professionals who offer a personal touch, such as mortgage lenders and real estate agents, were preferred by a wide margin over online sources. Consumers have also indicated that while they prefer to do simpler mortgage activities online, including bill-paying, they still believe more complex mortgage tasks require personal interaction. These results were consistent across all age groups," Smith continued.

These observations were among the findings in Fannie Mae's fourth-quarter lender sentiment survey for 2019. A total of 188 executives from 168 lending institutions participated in the study, 60 of which were large mortgage originators, 38 were midsized and 70 of which were smaller. The respondents included 76 mortgage bankers, 60 depositories, 30 credit unions and two others.