Life insurance companies increased their mortgage investments to levels higher than historical norms, creating more potential danger for their portfolios in the event of a real estate downturn, a Fitch Ratings report said.

"Insurers continued to see relative value in mortgages compared with other asset classes, and are driving exposures higher as they trade liquidity for yield," Nelson Ma, director of North American insurance at

Historically, life insurers allocated between 8% and 12% of their investment portfolio for mortgages, primarily loans secured by commercial real estate. But by the end of 2018, the allocation was 12.9%, up from 12.4% the year before.

The continued increase has taken place over the last four years, Fitch noted. And this trend is broad-based "across the life insurance industry rather than large increases by a few large investors," the report said.

At the end of last year, 60% of life insurers had mortgage investment allocations over 12%, with 20% having allocations of 17% or above, "which Fitch views as an above-average concentration and makes the investment portfolios potentially more vulnerable in a declining real estate scenario."

"Fitch notes a number of companies with above-average mortgage concentrations had a demonstrated track record of good performance within this asset class during the financial crisis," the report said. "Additionally, some of the life insurers with above-average concentrations to mortgages, including

The increased investments came at a time when yields declined slightly, to 4.5% in 2018 from 4.6% the year prior. Newer mortgages with

Still, mortgages were more attractive from a yield standpoint for life insurers compared with BBB-rated bonds.

Troubled mortgages — restructured, delinquent and foreclosed loans — fell to 39 basis points last year, down from 44 basis points in 2017. Restructured loans dropped, while delinquencies remained flat and foreclosures ticked up.

"Fitch expects mortgages will continue to perform well over the next 12-24 months, given generally stable property market fundamentals and stable economic conditions. However, pressure remains in certain markets with exposure to large amounts of new construction, as well as with certain property types, such as retail where e-commerce and store closings are having a detrimental effect on property performance. Fitch believes most insurers remain prudent, and any change or reversal in credit quality is expected to be manageable," the report said.

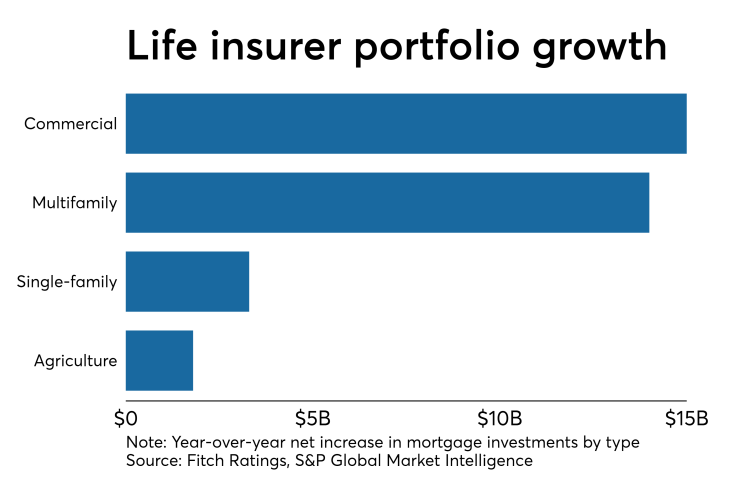

Life insurers' net investments in

Commercial mortgages (excluding multifamily) grew by 5%. The growth rate was muted, Fitch said, by declines in this category at MetLife and Voya Financial.

Still, MetLife's total mortgage investments grew by 6% as a result of increased allocations for residential and

The sale of the closed-block variable annuities and fixed annuities business partially resulted in Voya's decline; a portion of its total mortgage investments accompanied the sold business.

Agricultural mortgage investments grew by 9% or $1.8 billion. However, only 20% of the life insurers Fitch covers invest in agricultural loans.

Commercial mortgages accounted for 71% of life insurers' investments at the end of last year, followed by multifamily at 15%, while single-family and agricultural loans made up 5% each.

An area of concern was the increase in shorter-term funding on more transitional assets like bridge loans or commercial real estate collateralized loan obligations, as well as the continued prevalence of interest-only loans as a percentage of the total investment portfolio.

And in the broader sense of commercial real estate lending, mortgages secured by retail remained a concern because of store closures and the shift to online retail, Fitch said.