Low-down-payment purchases are on the rise, but not necessarily with the same practices and risk factors of the past, according to Black Knight Financial Services.

Nearly 1.5 million borrowers made a home purchase using down payments of less than 10% in the past 12 months, marking an almost seven-year high in low-down-payment purchase volumes.

The bulk of low down payments were not from the trending

Despite speculation on the re-emergence of purchase loans with loan-to-value ratios of 97% or higher, today's purchase lending trends have a very different risk profile than in 2005-2006 during the run-up to the financial crisis, according to Ben Graboske, executive vice president of data and analytics at Black Knight.

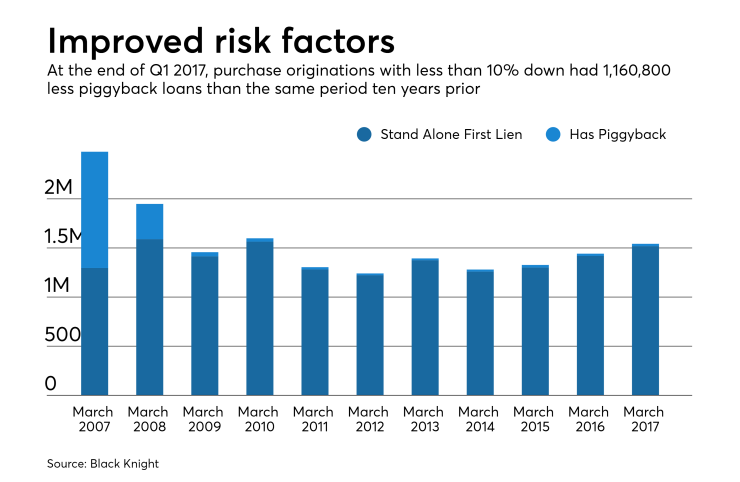

"[Leading up to the crisis] half of all low-down-payment purchase originations involved 'piggyback' second liens, as opposed to a single high-LTV first-lien mortgage," said Graboske.

He also explained that in the pre-crisis years, a great portion of low-down-payment loans were more risky adjustable-rate mortgages.

"ARMs are virtually nonexistent today among high-LTV loans," Graboske said. "Perhaps the most telling difference is that borrowers using these programs today have average credit scores roughly 50 points higher than those approved for high-LTV purchase loans in 2004-2007. Among GSE loans with down payments under 5%, average credit scores are 60 points higher today."

With improved risk profiles of borrowers, high-LTV mortgage defaults remain low and with better performance. The serious delinquency rate of government-sponsored enterprise purchase loans with more than 96% LTV have a serious delinquency rate over 90% below those originated in 2004-2005.

Though the increase in low-down-payment purchase volumes is due primarily to purchase lending growth, they have ticked upwards in market share over the past 18 months, after almost four years of declines, and now account for almost 40% of purchase lending.

While the Federal Housing Administration and Department of Veterans Affairs serve as primary resources for low-down-payment lending, the market share in this segment has declined as GSEs have expanded low-down-payment options. Fannie Mae and

Over 25% of all GSE purchase loans are going to borrowers putting less than 10% down.