Nearly half of July's millennial homebuyers were single, a sign that they are not waiting for certain milestones like marriage before deciding to become homeowners, Ellie Mae said.

Furthermore, 53% of the single millennial buyers were male, while 40% were female; for the other 7% the gender was unspecified.

Single millennial homebuyers had an average loan amount of $172,904 and an average credit score of 720. Their married cohorts had a higher average loan balance, $277,651, and a 729 average credit score.

"Millennials are purchasing more homes than any other generation, and we're seeing many single borrowers take advantage of opportunities now rather than waiting to purchase a home around a big life event such as getting married or starting a family," Joe Tyrrell, executive vice president of corporate strategy for Ellie Mae, said in a press release. "We're also seeing millennials get more for their money by purchasing homes in affordable markets."

In July, 90% of all closed loans made to millennials were for purchases, compared with

In the nation's 10 largest markets by population size, the highest share of closed loans made to millennials was in Philadelphia, at 40%. Chicago and Houston each had a 38% share, while Washington and Boston had a 35% share. New York, Dallas and Atlanta had a 33% share with Miami having a 27% share and Los Angeles a 22% share.

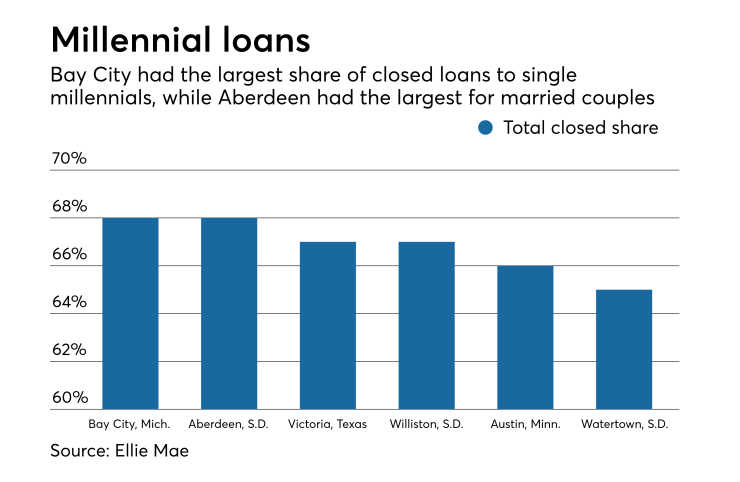

On the other hand, six smaller cities had a percentage of closed loans to millennials of 65% or more: Bay City, Mich., 68%; Aberdeen, S.D., 68%; Victoria, Texas, 67%; Williston, N.D., 67%; Austin, Minn., 66%; and Watertown, S.D., 65%.

Bay City had the largest share of closed loans to single millennials, at 68%, while for married borrowers it was Aberdeen at 76%.