Most millennials who don't own a home plan to buy one in the next five years. But many of those would-be buyers may not be saving enough for their purchase, according to a report from HSBC.

A study conducted by HSBC found that 80% of millennials who are not homeowners intend to purchase one within the next five years. Many of these consumers remain worried about the cost of buying a home though.

Seventy-one percent of millennials surveyed by HSBC said they had not saved up enough to afford a deposit. The same share of respondents said that they would need a higher salary to be able to purchase a home, which could be a problem since home price appreciation is outpacing wage growth.

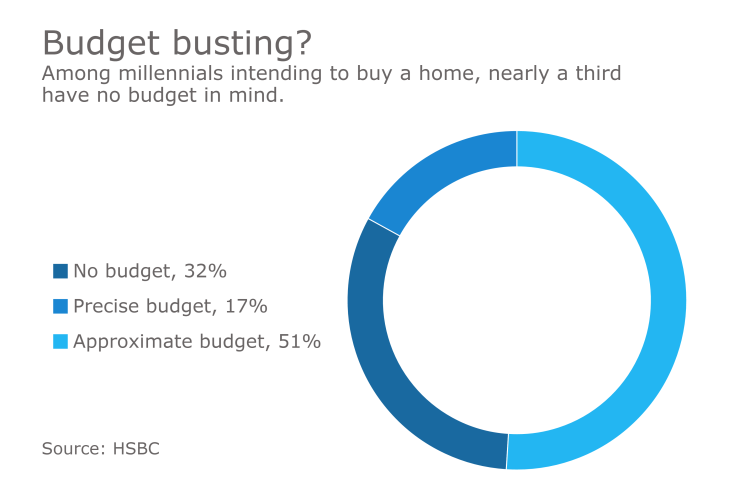

Despite this emphasis of affordability, many of the millennials who said they want to be homeowners have yet to set a budget. Roughly a third of respondents reported they have no budget in mind, while 52% only had an approximate budget. Unsurprisingly, 57% of millennials who purchased a home within the last two years said they ended up overspending.

Millennials aren't alone in this regard: HSBC found that 34% of all non-owners intending to buy have not set a budget, while 49% have a rough one. Among all buyers who overspent, mortgage payments were a contributing factor in 41% of these cases.

In cases where millennials did overspend, it wasn't mom and dad who always covered the gap. The top two ways millennial homeowners managed unexpected costs were withdrawing from savings and cutting back on spending. Only 28% of them reported needing to borrow money from family members.

And millennials are not averse to making sacrifices to afford a home purchase. For instance, 55% said they would consider spending less on leisure activities, while 41% said they would entertain buying a smaller property than desired.