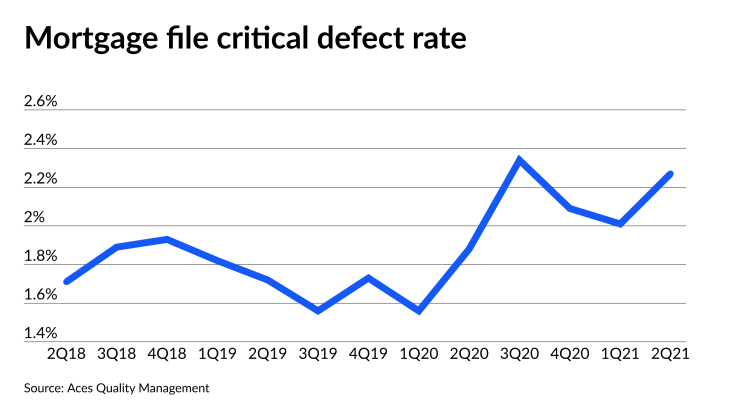

Mortgage application critical defects increased for the first time in three quarters, as errors in the income and employment category were at the highest level since Aces Quality Management started this report in 2016.

The second quarter critical defect rate rose 13% over the first quarter to 2.27%. In the first quarter, the rate was 2.01%, while in the

"Several factors contributed to the increase in the critical defect rate, including the transition from a refinance market to a

Defects are not proof that someone has perpetrated a fraud in order to obtain a mortgage, but they are red flags that signal that the loan must be examined. Furthermore, defects can result in a loan repurchase request from a secondary market investor.

Problems with the applicant's income and employment made up 32.08% of all defects, compared with 31.44%

The next most cited defect category, loan documentation, made up just 12.5% of errors, up 13 basis points from the first quarter.

Legal and regulatory compliance defects increased by 155 bps from the first quarter to 10.83%. "We expect defect share in these manufacturing-related categories to remain stable or improve in future quarters as volume pressures make the loan origination process more predictable overall," the Aces report said.

Borrower and mortgage eligibility defects also were at 10.83%, down from 14.43% in the first quarter.

The share of asset-related defects was also lower, down to 10% from 12.37% on a quarter-to-quarter basis.

Credit defects slipped to 7.5% from 12.89%. But appraisal defects increased to a 5.42% share from 2.58%, because of the shift to a purchase market. Lenders need to increase their risk management and quality control efforts in this area as a result, the report said.

Despite the higher critical defect rate, the second quarter data revealed some positive trends, including mortgage origination volume stabilization and

"These, combined with other economic factors, provide some optimism for the coming quarters, though the possible effect of inflation on interest rates may dampen that outlook," said Aces CEO Trevor Gauthier. "Given the uncertainty of 2022's market and increasing regulatory pressures, lenders must ensure their existing QC and compliance programs are leveraging automation to maximize loan quality and mitigate risk."