Want unlimited access to top ideas and insights?

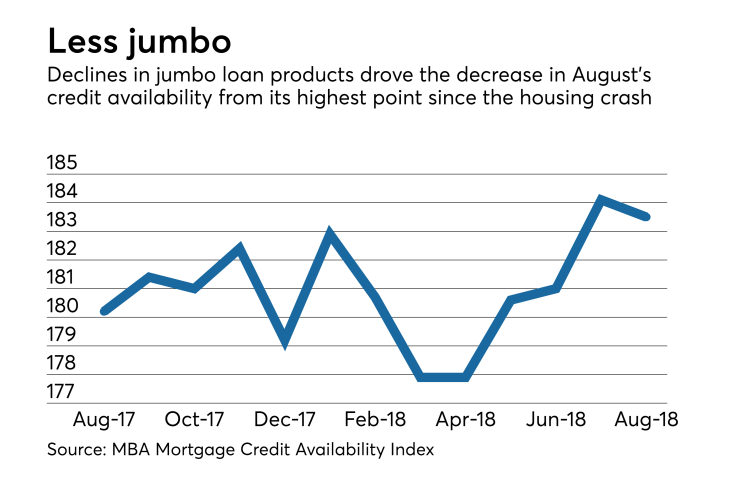

Mortgage credit accessibility dropped for the first time in four months as jumbo loan products took a step back, according to the Mortgage Bankers Association.

The MBA's Mortgage Credit Availability Index declined 0.3% in August, dropping 0.6 percentage points

"Overall credit availability saw a slight decrease in August, for the first time in four months, as the jumbo index retreated from its record high in July," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release.

"Strong month-over-month increases in the jumbo index reversed because of a reduction in the number of jumbo programs. The decline in jumbo credit availability was offset partially by an increase in the conforming index, which increased over the month due to the addition of low down payment programs."

The conventional MCAI fell 0.9% but the government MCAI inched up 0.1%. The component indices within the conventional MCAI were split as well, with the jumbo index dropping 2.1% while the conforming index grew 0.8%.

The index tracks changes in a variety of underwriting criteria, like credit score requirements and loan-to-value ratios, to show relative changes in industrywide credit risk and access to mortgages. The index is calculated by the MBA using loan program data from Ellie Mae's AllRegs Market Clarity database with a benchmark of 100 in March 2012.