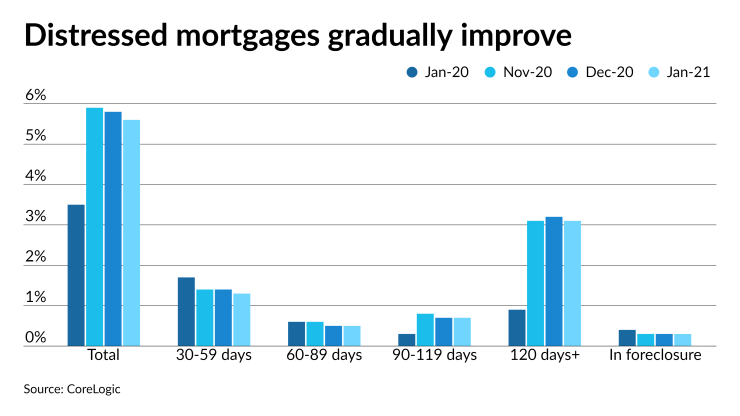

Distressed mortgage rates improved for the fifth straight month in January but unstable job markets led to uneven recovery across the country, according to CoreLogic.

The Loan Performance Insight report showed the overall delinquency rate declined to 5.6% from

Louisiana had January’s highest delinquency rate at 9.2%, trailed by 8.4% in Mississippi and 8% in New York. Hawaii, Nevada and Florida saw the largest annual growth in delinquency, jumping 4.2, 4.1 and 3.1 percentage points, respectively.

“The U.S. unemployment rate rose 2.8 percentage points over the year to 6.3% in January 2021 from 3.5% in January 2020,” Nothaft said. “The Hawaii unemployment rate spiked 8.3 percentage points and the Nevada unemployment rate jumped 4.8 percentage points, far more than the national average.”

The share of 30- to 59-day delinquencies dipped to 1.3% after sitting at 1.4% for three months in a row and decreased from 1.7% year-over-year. The rate for 60- to 89-day delinquencies held at 0.5% month-over-month and edged down from 0.6% annually.

The transition rate of the early-stage delinquencies was the lowest since March 2020 and will likely continue declining with further improvements in the job market, Nothaft added.

Serious delinquencies — loans 90 days or more past due, including foreclosures — dropped to 3.8% from 3.9% in December, but more than tripled the year-ago rate of 1.2%. Mortgages past 120 days due but not yet in foreclosure similarly fell to 3.1% from 3.2% month-to-month while sitting over three times higher than 0.9% in January 2020.

Aided by

The three states with the highest foreclosure rates remain unchanged from the last two months, with rates of 1.1% in New York and 0.8% in both Hawaii and Maine. A group of 15 states had rates of 0.1% or lower.