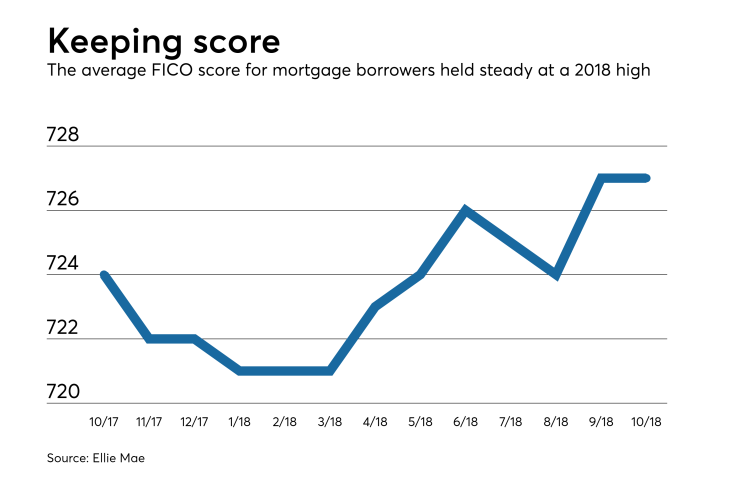

Average credit scores for mortgage borrowers remain at a 2018 high, a sign that lenders aren't easing standards despite refinance candidates already falling off on higher rates, according to Ellie Mae's Origination Insights report.

The average borrower FICO score for loans closed in October rose three points to 727 year-over-year and remained unchanged from its year-high hit the

All the while, the refinance share of mortgages closed in October tanked 10 percentage points from the previous year, bumping up the purchase share from 61% to 68%, and mortgage origination amounts overall are

But lenders are still hesitant to take on more risk to help homebuyers, already struggling with rising home prices and mortgage rates, enter the market.

"As interest rates continue to rise, the percentage of adjustable-rate mortgages is increasing as homebuyers are looking to take advantage of the best rates from their lenders," said Ellie Mae President and CEO Jonathan Corr in a press release. "Additionally, FICO scores remain the highest we've seen in 2018, indicating that lenders are not yet loosening credit availability to attract the shrinking refinance market."

Closing rates, however, have increased, meaning mortgage applications started in the previous 90 days are more likely to close than a year ago. The closing rate for all loan types hit a 2018 high of 72.2% in October, up from 70.4% a year ago.