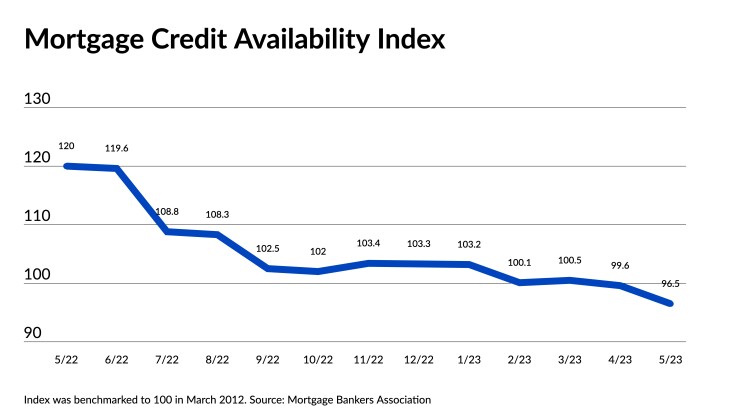

Mortgage credit tightened even further in May

The MBA's Mortgage Credit Availability Index, or MCAI, the results of which are determined through analysis of industry data provided by ICE Mortgage Technology, dropped for a third straight month, finishing with a reading of 96.5 in May. The score came in 3.1% under April's 99.6 score and also represents a steeper year-over-year falloff of 19.6% from May 2022, when the MCAI clocked in at 120.

The index was benchmarked to a score of 100 in March 2012, meaning credit is tighter today than it was at that time.

The downwardly trending data comes following a recent wave of home lending mergers and banking industry troubles, both leading to reduced credit offerings for mortgage borrowers, according to Joel Kan, MBA vice president and deputy chief economist.

"The industry continued to see more consolidation and reduced capacity as a result of the tougher market. With this decline in availability, the MCAI is now at its lowest level since January 2013," he said in a press release.

Credit decreased across all categories measured by the trade group, with the Government MCAI, which includes many types of loans commonly used by new mortgage borrowers, dropping 3.8% to its lowest level since early 2013. The decrease follows a fall of 2.1% in April, with credit tightening adding one more hurdle for a segment of consumers already facing heightened home affordability challenges.

"In a market where a significant share of demand is expected to come from first-time home buyers, the depressed supply of government credit is particularly significant," Kan said.

Tighter underwriting standards may also be contributing to fewer options, as lenders look closely at loan-to-value ratios and other borrower criteria in the current market. "Lenders pulled back on loan offerings for higher LTV and lower-credit-score loans, even as loan applications continued to run well behind last year's pace," Kan added.

The Conventional MCAI also saw a downward turn of 2.3% in May, compared to a 0.5% rise a month earlier, with both jumbo and conforming components decreasing. The conforming index fell 3.9% between April and May to land at its lowest mark since 2011, the year it was first introduced. One month earlier, conforming loan products experienced a more muted 1.1% decline

Similarly, jumbo availability declined, as the housing market processed the

"The jumbo index fell by 1.5% last month, its first contraction in three months, as some depositories assess the impact of recent deposit outflows and reduce their appetite for jumbo loans," Kan said.

The slide in the overall MCAI first began in early 2022, picking up steam in the second half of the year, as interest rates surged and business declined in tandem. While the MBA sees a 20% annual drop in originations for 2023,