The mortgage market had already priced the Federal Open Market Committee's 25-basis-point hike into its rates so there was little change, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 3.93% | 3.36% | 3.36% |

| Fees & Points | 0.5 | 0.5 | 0.3 |

| Margin | N/A | N/A | 2.75 |

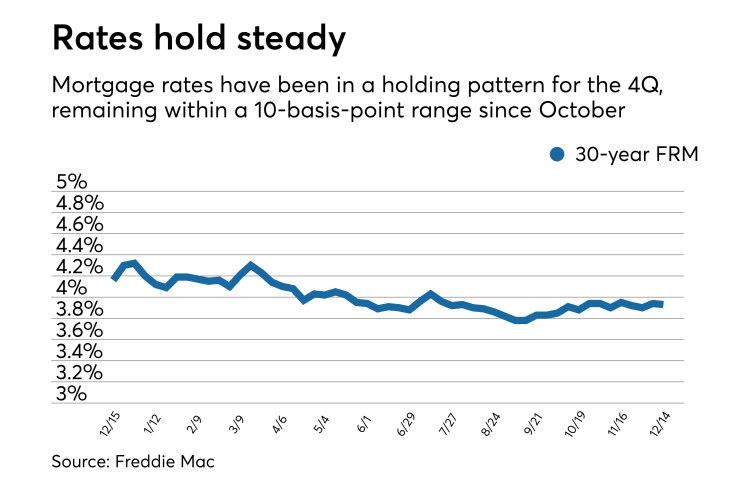

The 30-year fixed-rate mortgage averaged 3.93% for the week ending Dec. 14,

"As widely expected, the Fed increased the federal funds target rate this week for the third time in 2017. The market had already priced in the rate hike so long-term interest rates, including mortgage rates hardly moved. Mortgage rates held relatively flat across the board, with the 30-year fixed mortgage rate inching down one basis point," Len Kiefer, Freddie Mac's deputy chief economist, said in a press release.

"Mortgage rates have been in a holding pattern for the fourth quarter, remaining within a 10-basis-point range since October," Kiefer said.

The 15-year fixed-rate mortgage averaged 3.36%, the same as last week. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.37%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.36%, up from last week when it averaged 3.35%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.19%.

"The Fed announcement was largely in line with expectations and markets had already priced in higher short-term lending rates. Under Chair Janet Yellen, the Fed has had a track record of predictability and forecasting policy changes well in advance — a reputation that continued through Yellen's last FOMC press conference," Aaron Terrazas, Zillow's senior economist, said when that company released its own rate tracker on Wednesday.

Current FOMC guidance calls for three rate hikes in 2018, but the Mortgage Bankers Association said it is likely to be increased to four.

"The Fed's expected path of increasing short-term rates and continuing to shrink its balance sheet over the next few years will put upward pressure on mortgage rates in 2018, but we expect that short rates will continue to increase faster than long rates, leading to a flatter yield curve," said MBA Chief Economist Mike Fratantoni in a statement.

"We do expect that mortgage rates may also become somewhat more volatile in the year ahead, particularly as the Fed allows its mortgage-backed securities portfolio to run off at a faster rate through the course of the year."