-

The Federal Housing Finance Agency recently became the third agency along with the Office of the Comptroller of the Currency and Consumer Financial Protection Bureau without a Senate-confirmed leader. But analysts say the appointment of interim chiefs gives the administration even more control over regulatory initiatives.

July 9 -

The Treasury secretary previewed President Biden's budget by urging lawmakers to fund the Financial Crimes Enforcement Network's establishment of a beneficial ownership regime.

May 27 -

The Financial Stability Oversight Council has struggled to find its footing since its creation in Dodd-Frank. The Treasury secretary has signaled a more aggressive role for the panel, including reviving its authority to target nonbank behemoths.

April 8 - LIBOR

The heads of the Federal Reserve and Treasury are urging passage of legislation that would replace Libor with the Secured Overnight Financing Rate in certain contracts. That would spare banks litigation over trillions of dollars of contracts when Libor expires in 2023.

March 26 -

Janet Yellen was confirmed by the U.S. Senate as the country's 78th Treasury secretary and the first woman to hold the job, putting her in charge of overseeing an economy that continues to be hobbled by the coronavirus pandemic.

January 25 -

The incoming administration chose a battle-tested policymaker who can draw on her nearly two decades at the Fed to help rebuild an economy still struggling from the coronavirus pandemic.

November 30 -

The Trump administration has compelled the Federal Reserve to shut down the Main Street Lending Program and other facilities that aid banks’ pandemic relief efforts, but President-elect Biden’s Treasury nominee could help turn the spigot back on.

November 24 -

Former Chair Janet Yellen defended the Fed, expressed worry for the economy and gave advice to women on the rise at the MBA Annual Convention this week.

October 17 -

Powell, a former investment banker who has served as a Fed governor, was confirmed by the Senate last month to a four-year term as chair of the central bank.

February 5 -

Mick Mulvaney, acting director of the Consumer Financial Protection Bureau, said his zero-funding request for the agency is not meant to drain it of resources.

January 23 -

Mick Mulvaney, the acting director of the Consumer Financial Protection Bureau, has requested no funding from the Federal Reserve in the second quarter and instead will use reserves to fund the agency.

January 18 -

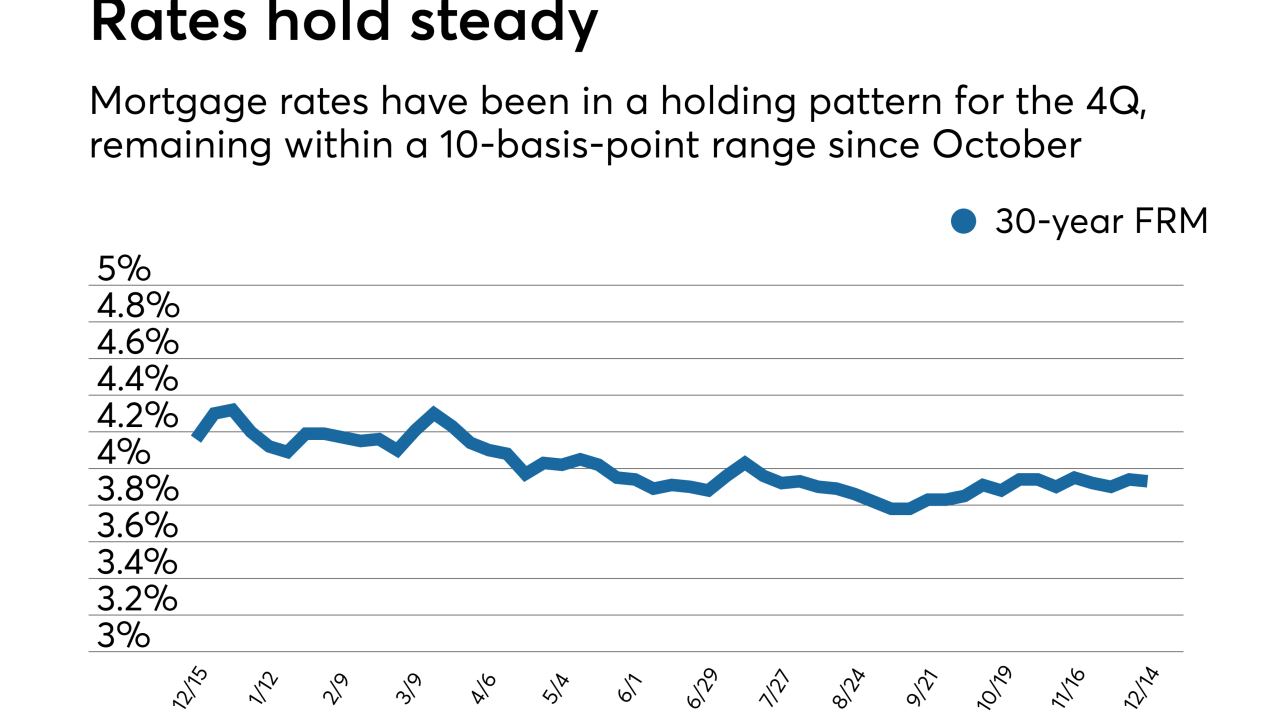

The mortgage market had already priced the Federal Open Market Committee's 25-basis-point hike into its rates so there was little change, according to Freddie Mac.

December 14 -

Mortgage rates moved lower this week, but strong economic data and comments by the outgoing Federal Reserve chair left many anticipating higher rates, according to Freddie Mac.

November 30 -

Federal Reserve officials meeting earlier this month saw an interest-rate increase in the near term even as divisions persisted over the policy path forward amid tepid inflation.

November 22 -

Federal Reserve Chair Janet Yellen announced Monday that she intends to step down from the Board of Governors after her successor is sworn in when her term expires early next year, ending any speculation that she may stay on.

November 20 -

Many industry observers believe Federal Reserve Board Janet Yellen will retire from the central bank once her term as chair expires in February. But there are reasons she might stay.

November 3 -

Fed Gov. Jerome Powell, who was first nominated to the central bank by former President Obama, is widely seen as a continuity choice.

November 2 -

If President Trump picks Federal Reserve Board Gov. Jerome Powell as its next chair, it may represent the best of all worlds for bankers — a policymaker who will continue the central bank's monetary policy but be open to regulatory changes.

October 30 -

Federal Reserve Chair Janet Yellen said Wells Fargo’s treatment of customers was “egregious and unacceptable," hinting that more regulatory action was likely.

September 20 -

Federal Reserve Chair Janet Yellen defended post-crisis reforms but allowed that further adjustments may be necessary to reduce adverse effects on small businesses and subprime borrowers.

August 25