Even though the Federal Open Market Committee

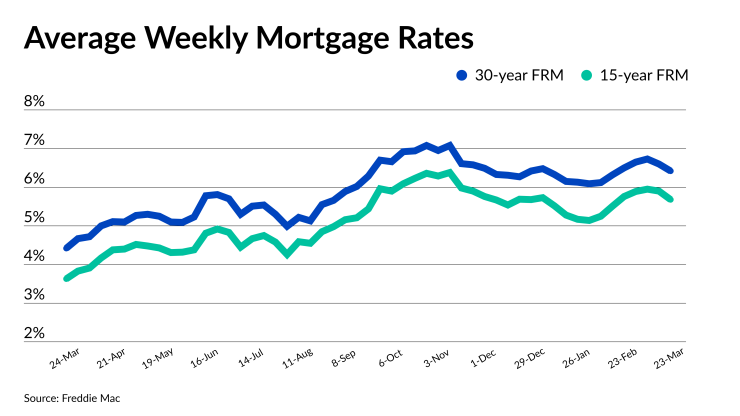

The Freddie Mac Primary Mortgage Market Survey found the 30-year fixed rate product averaged 6.42% as of March 23. This is a drop of 18 basis points from 6.6%

The 15-year FRM average slipped even more, by 22 basis points, to 5.68%, from 5.9% for the week of March 16. But that is up from 3.63% in 2022.

This drop is a function of the instability created by the

"However, on the homebuyer front, the news is more positive with improved purchase demand and stabilizing home prices," Khater said. "If mortgage rates continue to slide over the next few weeks, look for a continued rebound during the first weeks of the spring home buying season."

On March 9, the day before California banking regulators seized control of Silicon Valley Bank, the 10-year yield started trading at just above 4%.

Following the Fed meeting on March 22, it continued moving down and ended the day at 3.5%. As of noon on March 23, it was 3.47%.

"Hiking interest rates, even if more slowly, will devastate Main Street and Wall Street alike by wiping out millions of jobs while sending Treasury securities into a downward spiral," read a statement from Liz Zelnick, director of economic security and corporate power at consumer watchdog Accountable US. "A recession and broken financial system are not worth the price of higher interest rates that have failed miserably to curb the corporate greed epidemic helping to drive up costs."

The talk around the Fed's actions reinforced prior guidance on the housing market from the Mortgage Bankers Association.

"With this move from the Federal Reserve, MBA is holding to its forecast that mortgage rates are likely to trend down over the course of this year, which should provide support for the purchase market," said Mike Fratantoni, its chief economist, in a statement. "The housing market was the first sector to slow as the result of tighter monetary policy and should be the first to benefit as policymakers slow — and ultimately stop — hiking rates."

The Fed is indicating it will continue the quantitative tightening program of letting its bond portfolio, including mortgage-backed securities, run off, he added. "We expect that the recent increase in direct lending by the Fed through the discount window and the new term lending facility will help to improve liquidity for banks, despite this ongoing reduction in the size of the Fed's securities holdings."

A pause in rate hikes of the Fed Funds rate might be a signal it remains concerned about financial stability, pushing investors into buying 10-year Treasuries and pushing down mortgage rates, said Odeta Kushi, deputy chief economist at First American Financial, in a statement.

"The Fed had a tough choice," Kushi said. "Continue to fight inflation, raise rates, and see if the real estate crash test dummy can withstand the shock, or pause and see if the banking system responds favorably or depositors lose confidence, and another crash test dummy goes through the windshield."

Going forward, mortgage rate changes are dependent on market dynamics. "Tighter financial conditions could restrict mortgage lender's access to funding sources, resulting in a higher spread between the 30-year fixed mortgage rate and the yield on the 10-year Treasury," said Orphe Divounguy, senior macroeconomist at Zillow Home Loans, in a statement. "Next week's inflation reading from the PCE price index will likely cause more mortgage rate volatility."

But rates remaining high will continue to negatively impact mortgage origination activity in 2023, said Bose George, an analyst with Keefe, Bruyette & Woods, in a report.

"Additionally, it is unclear how much more capacity

However, mortgage technology provider Maxwell is positive about origination activity for the rest of 2023, based on its analysis of over $200 billion of transactions from more than 250 small- and mid-sized originators that used its platform from 2021 through early this year.

While loan volume last year declined by a quarterly average of 26% as rates rose, so far in 2023, average weekly activity is up 22% over the fourth quarter as of early February, Maxwell's latest quarterly report said. A busier, more competitive spring selling season driven by pent-up demand is likely, the company continued.

"The stabilization of mortgage rates could prove to be a moderate accelerant for loan volume," said Anthony Ianni, Maxwell's vice president of solutions, in a press release. A $100,000 loan at 3%, has a monthly payment of $422. If rates fall to 5.5%, the payment rises to $568 per month.

"That kind of difference may be small enough that many people will accept it in order to upgrade or relocate, or for a home seller to trade back some of their equity at closing to the buyer to cover the difference," Ianni said.