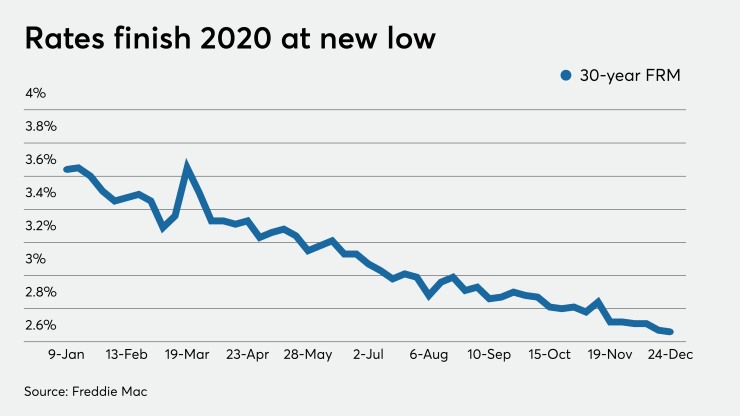

Mortgage rates yet again have dropped to a record low, even as the yield on the benchmark 10-year Treasury flirts with breaking back above the 1% mark, according to Freddie Mac.

The 30-year fixed-rate mortgage averaged 2.66% for the week ending Dec. 24,

However, the 10-year Treasury yield rose over the prior seven day period. It closed at 0.955% on Dec. 23, up 3.5 basis points compared with one week earlier. In fact, at one point during Dec. 23, the 10-year yield was at 0.973%, its highest level since Nov. 10.

Still, the low mortgage rates have made for a nice holiday surprise for what is normally a slow time of the year for the housing market. Purchase applications

“The housing market is poised to finish the year strong as low mortgage rates continue to fuel homebuyer demand and refinance activity,” Sam Khater, Freddie Mac’s chief economist, said in a press release.

“Moving into 2021, we expect rates to hold steady, but the key driver in the near term will be the trajectory of the COVID-19 pandemic and the execution of the vaccine.”

The 15-year fixed-rate mortgage averaged 2.19%, down from last week when it averaged 2.21%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.19%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.79% with an average 0.2 point, unchanged from last week. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.45%.