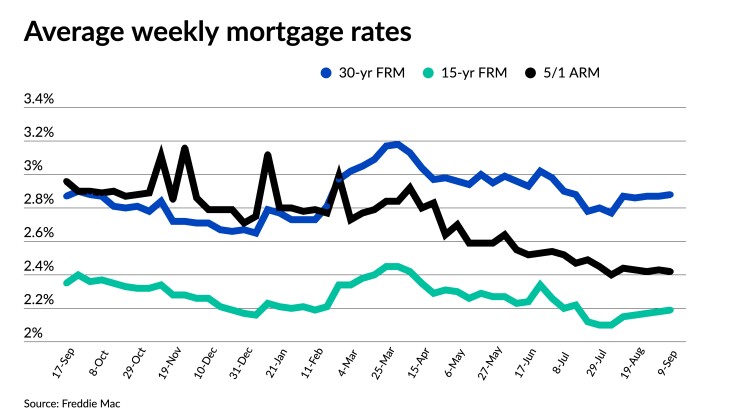

Fixed-rate averages inched up slightly over the past week, as subpar August employment numbers failed to cause waves that generally move rates.

The average 30-year fixed-rate mortgage came in at 2.88% for the weekly period ending Sept. 9, climbing a single basis point from 2.87%

“While the economy continues to grow, it has lost momentum over the last two months due to the current wave of new COVID cases that has led to weaker employment, lower spending and declining consumer confidence,” Sam Khater, Freddie Mac’s chief economist, said in a press statement.

“Consequently, mortgage rates dropped early this summer and have stayed steady despite increases in inflation caused by supply and demand imbalances.”

U.S. economic data seesawed between hot and cold over the spring and summer, and the

“However, the dynamic that followed the August report, which was released last Friday, bucked the typical trend as bond yields and mortgage rates rose upward following the disappointing report,” Speakman said in a blog post.

Speakman couldn’t quite put his finger on one specific reason for the abnormal market movements, but “the upward move in yields may suggest that investors are growing concerned about inflation,” he noted. Inflation has accelerated at its fastest pace in over a decade since spring, as the U.S. emerged from the economic stress caused by the pandemic, yet

“It could also suggest that investors are looking past the weak report, having anticipated a lackluster report given recent consumer confidence in recent weeks,” Speakman added.

Investors and economists will next turn their eyes to August inflation numbers, scheduled for release on Sept. 14, looking for signals about the pace of the economic recovery, and its potential effect on rates.

In tandem with the 30-year rate, other primary mortgage categories moved minimally over the past week. “The net result for housing is that these low and stable rates allow consumers more time to find the homes they are looking to purchase,” Khater said.

The average 15-year fixed-rate mortgage climbed a single basis point to 2.19% from 2.18% a week earlier. In the same time frame one year ago, the rate averaged 2.37%.

The 5-year Treasury-indexed adjustable-rate mortgage headed slightly in the other direction, dropping one basis point to 2.42% from 2.43% week over week. During the same week of 2020, the 5-year adjustable rate stood at 3.11%.