Mortgage applications decreased 1.8% from one week earlier as refinance submissions fell to their lowest in nearly 18 years, according to the Mortgage Bankers Association.

The MBA's Weekly Mortgage Applications Survey for the week ending Sept. 7 found that the refinance index decreased 6%

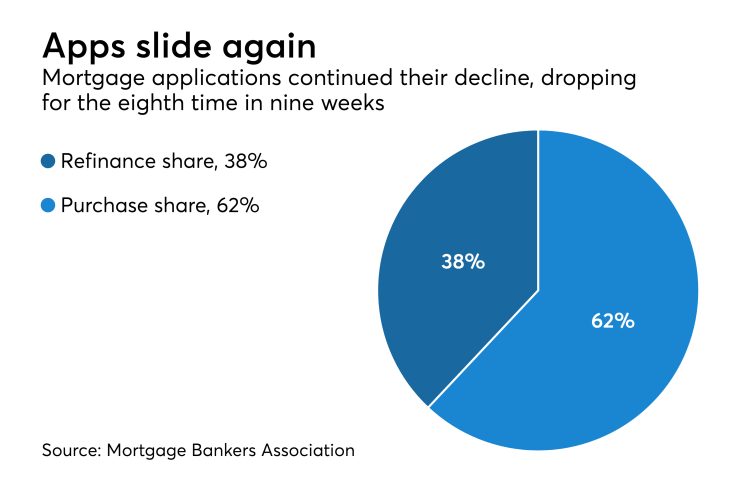

The refinance share of application activity decreased to 37.8% from 38.9% the previous week.

"As mortgage rates increased to a five-week high, the refinance index decreased to its lowest level since the end of 2000," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release. "The drop in refinance activity pushed overall mortgage applications lower last week. Treasury rates increased through the week, mainly in response to stronger data on the manufacturing sector, unemployment claims and signs of faster wage growth."

The seasonally adjusted purchase index increased 1% from one week earlier, while the unadjusted purchase index decreased 11% compared with the previous week and was 4% higher than the same week one year ago.

Adjustable-rate loan activity increased to 6.4% from 6.1% of total applications, while the share of Federal Housing Administration-guaranteed loans increased to 10.4% from 10.2% the week prior.

The share of applications for Veterans Affairs-guaranteed loans increased to 10.5% from 10% and the U.S. Department of Agriculture/Rural Development share remained unchanged at 0.8% from the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased 4 basis points to 4.84%. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $453,100), the average contract rate increased 5 basis points to 4.72%.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA increased 5 basis points to 4.84%, while for 15-year fixed-rate mortgages the average increased 5 basis points to 4.28%.

The average contract interest rate for 5/1 ARMs decreased 2 basis points to 4.07%.