The majority of mortgage lenders don't expect to use chatbots to communicate with clients anytime soon.

On the other hand 45% of lenders are current or test users of Application Programming Interfaces and in two years that is expected to grow to 59%, according to Fannie Mae's Mortgage Lender Sentiment Survey.

APIs "allow lenders and technology service providers to meet demands in a fast, agile and scalable way. APIs will reshape how work is done and how companies compete. Lenders who do not expect to adopt APIs in the near future may well find themselves being pushed to the sidelines," said Tracy Stephan, director of economic and strategic research, in a blog post on Fannie Mae's website.

Only 2% of mortgage lenders use chatbots now, with another 2% testing them. Right now 17% are investigating their use.

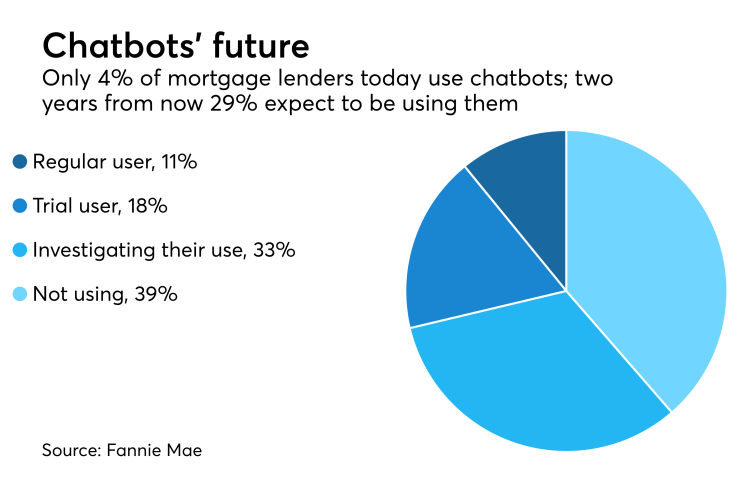

When asked if in two years the lender expects to be using a chatbot, 11% said they will be regular users and 18% will be testing them out. But 39% said they won't be using them and 33% will be investigating the possibility.

Lenders of all sizes were concerned about data security and the need to dedicate funds and staff for both APIs and chatbots. Smaller lenders are not sure if these technologies are appropriate for a company of their size, Fannie Mae found.

There were 201 banks, mortgage bankers and credit unions that participated in the survey, with 82 defined as smaller lenders.

Only 30% of all the lenders surveyed said they were among the first adopters of new technology, while 64% said they take it on after most have used it and 7% are laggards.

For small lenders, only 13% are in the forefront and 80% adopt tech when most of their competitors have used it.

Approximately half of all lenders said what kept them from being an early adopter of new technology were concerns over integration, functionality, reliability and scale, while 21% said it was because they did not have an in-house technology staff.

When asked where the three greatest potential uses for a chatbot would be, 54% said during the loan application process (including communicating at the point of sale and with appraisers), 29% said during the verification process, 23% said delivering closing documents and getting them signed and 15% said during the underwriting process.

On the servicing side, 37% of those surveyed said the best use is for responding to customer inquiries and 26% see chatbots being used to assist in receiving payments from borrowers.

For APIs, 44% said the best use is during the application stage and another 40% said it is for verifications. For servicing a loan, 23% said the best use for an API is for receiving monthly payments.