Coronavirus-related forbearance exits slowed last week, decreasing only by 12,000 after they fell by 39,000 a week earlier, according to Black Knight.

But first-time forbearance starts rose by 40,000 over the past week — the biggest weekly increase since early September. These first-time starts jumped 19% in the last two weeks as overall forbearance starts grew 5%.

"The increase suggests that rising COVID-19 case rates and measures undertaken to try to control the spread may be contributing to an increased need for forbearance assistance," Andy Walden, Black Knight economist and director of market research, said in the report.

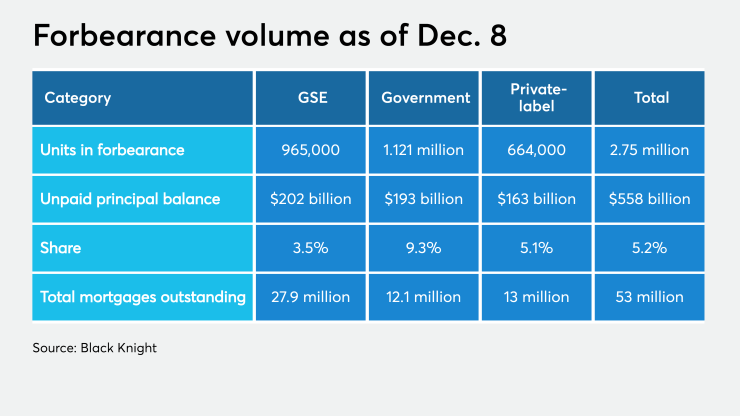

Approximately 2.75 million borrowers sat in active plans as of Dec. 8. The outstanding loans represent a 5.2% share of all active mortgages, combining for an unpaid principal balance of $558 billion. The totals reflect a 40% decrease

"This increase is due in part to limited forbearance expiration activity in November, which has resulted in reduced forbearance removal activity in early December compared to previous months," Walden said.

Active forbearances held by government-sponsored enterprises continue to lead the recovery, inching down another 2,000 from the week prior to 965,000. Portfolio and private-label securitized loans — which aren't

Black Knight's analysis shows mortgage servicers will need monthly advances of $3.3 billion in principal and interest payments and $1.2 billion due in taxes and insurance. Those break down to estimates of $1.1 billion and $400 million for Fannie Mae and Freddie Mac mortgages, $1 billion and $400 million for FHA and VA, and $1.1 billion and $400 million for private-label.