The New York Department of Financial Services disapproved the merger between Fidelity National Financial and Stewart Information Services, regulatory filings from both title insurance underwriters said.

The NYDFS did not comment on its decision. The agency oversees insurers as well as banks and mortgage lending in the state.

Nor was the reason disclosed in those filings. Specifically, the NYDFS rejected Fidelity National's application to acquire control of Stewart Title Insurance Co., a New York-domiciled title underwriter that only does business in that state.

New York regulatory approval is a closing condition for the transaction between the nation's largest (in Fidelity National) and fourth largest (Stewart) title underwriters.

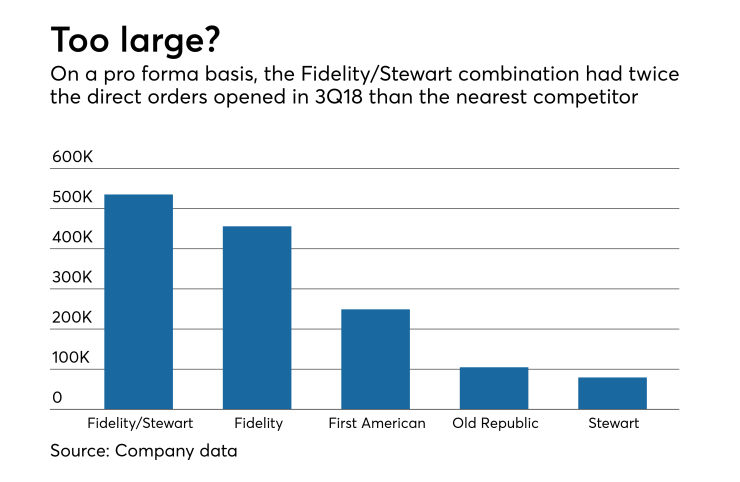

The two title insurers combined accounted for 44% of the industry's written premiums, Kroll Bond Rating Agency's 2019 outlook said. "Although the transaction is expected to close in the first or second quarter of 2019, KBRA believes that regulators may have concerns over a combined 44% market share. This does not mean the deal will not got through, but some concessions and/or divestitures would likely be needed," the outlook continued.

Based on pro forma title orders opened information from the third quarter, the combination's market share would be more than double No. 2 First American.

Both Fidelity and Stewart "are evaluating the appropriate course of action in light of the NYDFS' determination, which may include a discussion with the NYDFS to better understand its concerns and respond to the letter," Fidelity's regulatory filing said.

So far, 28 states have approved the deal, the filing added.

Furthermore, as previously disclosed, the companies received a second request from the Federal Trade Commission's Hart-Scott-Rodino as part of the antitrust determination process for approving the deal, the filing said.

Fidelity had

"Stewart and FNF continue to work actively to satisfy all of the regulatory conditions to the closing of the acquisition, including with the Federal Trade Commission, the Texas Department of Insurance and the NYDFS. As part of that process, the parties intend to reach out to the NYDFS to discuss the notice and seek to resolve the concerns raised therein, with which they respectfully disagree," the Stewart filing said.

In March 2018 Fidelity

Fidelity is releasing its year-end earnings on Feb. 14; Stewart has not announced a date.