Residential lender and Warburg Pincus portfolio company Newfi Lending is helping tackle upfront costs for homebuyers with the launch of its 2-1 Buydown Program.

Newfi can now provide seller concessions to borrowers to lower monthly payments for the first two years of the mortgage. This offering comes at a time when mortgage rates are on the rise, adding affordability constraints to purchasers already struggling with growing home prices.

The 2-1 Buydown program kicks off at closing with an upfront fee provided by the seller, which essentially reduces the interest rate over the beginning years of the loan. Newfi will place this upfront fee in an escrow account, which will be tapped monthly to help lower borrower payments. Buydowns will be calculated at a rate reduction of 2% for the first year and 1% for the second, according to Newfi.

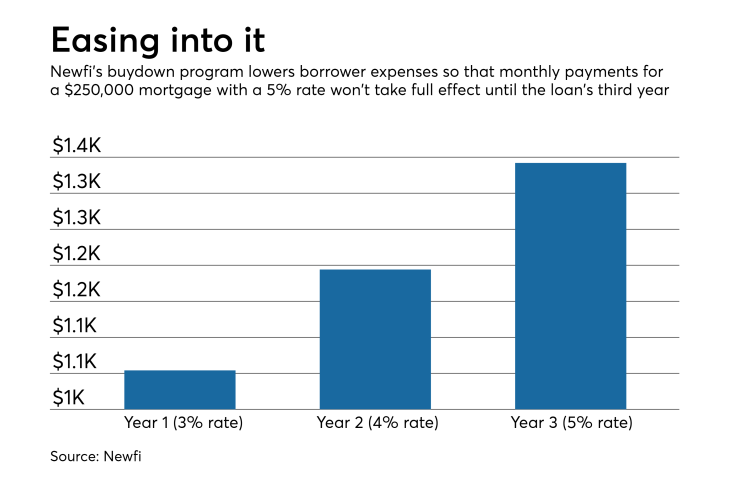

Typically, for a borrower with a $250,000 loan and a 5% mortgage rate, the monthly payment would be $1,342. But through Newfi's buydown program, the first-year rate of 3% will only require a monthly payment of $1,054, followed by payments of $1,194 for the second year at a rate of 4%, before the original rate takes effect in the third year.

This program launch highlights what's top-of-mind for the mortgage industry as it comes just days after builder Taylor Morrison Home Corp. launched a

Newfi's offering is applicable to 30-year and 15-year fixed-rate products through Fannie Mae and the Federal Housing Administration, according to the company.