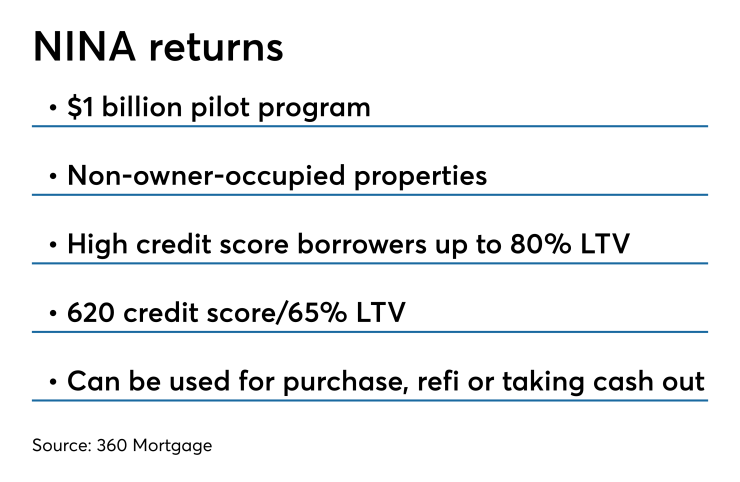

360 Mortgage is bringing back the no-income, no-asset loan, but says its $1 billion pilot's guidelines differ from those of the NINA loans that contributed to the financial crisis.

The program is not being sold to an agency, but is being underwritten to guidelines based on Fannie Mae's. The first phase is aimed at non-owner-occupied properties, explained 360 Mortgage Group Chief Operating Officer Andrew WeissMalik.

NINA loans — and similar products like stated-income, stated-asset, no-document and low-document mortgages — were cited as a source of

A big part of the problem with the boom-era NINA is "when banks went to foreclose on bad mortgage loans, there wasn't enough equity in the real estate to cover the losses the banks' experienced. And there was a snowball effect," WeissMalik said. As more of these properties were put on the market, home values continued to be depressed, which exacerbated the problem.

"The difference between the NINA product we're offering today and the NINA of the past, is quite frankly, the equity position the borrowers have," he said.

Those old NINAs had a lot of risk layering, with many loans having loan-to-value ratios of 100% or even 105% on purchases. Second liens could bring the combined LTV up to 125% or even 150%. Then in California and some other states, many had negative amortization features.

"Those are not the products we are offering. This is common-sense-based lending. There has to be a decent equity position in the property," WeissMalik said.

Higher credit score borrowers can get a mortgage with an 80% LTV. But for borrowers whose credit scores are around 620, the maximum LTV is 65%.

If there is a problem, the borrower has enough equity where they can sell the real estate and any losses the servicer might incur will be covered, he said.

Because the loan is secured by non-owner-occupied real estate, 360 Mortgage is looking at the cash flow from the property in order to determine if the borrower can make the payment, rather than their income. That's what makes this "a vastly different product" than in the past, he said.

These are non-qualified mortgages, "primarily because we're not looking at the borrower's debt ratio and it's not receiving exemptions under the other requirements for QM because it's not being sold to Fannie Mae or Freddie Mac," WeissMalik said.

It is available to mortgage brokers and correspondent originators. Once closed, some loans are kept in portfolio while others will be sold to an undisclosed investor. An undisclosed third party handles the servicing.

Once the $1 billion commitment is met, the company will evaluate the non-owner-occupied loans performance to see if additional occupancy types will be allowed. If the performance isn't there for properties with cash flow, it wouldn't be there for owner occupied homes, WeissMalik said.

"There's a whole generation of loan officers that may not know what the acronym NINA means and we're excited to bring what was a good product before they went with crazy terms back to the marketplace. We see a lot of potential," WeissMalik said.