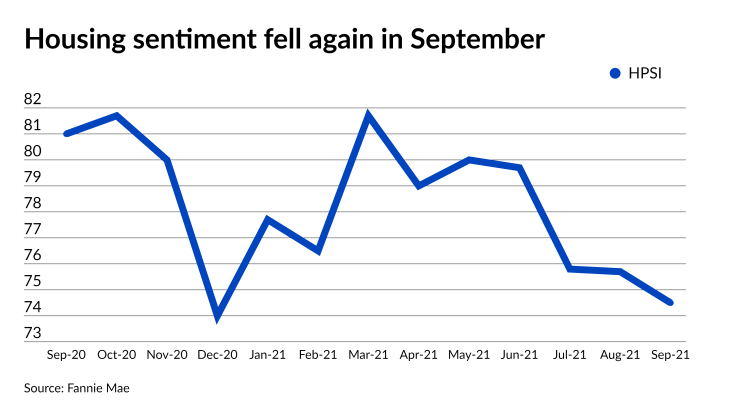

Amid record-breaking property home price growth, the Fannie Mae Home Purchase Sentiment Index continued its downward trend in September.

The overall HPSI score dipped to 74.5 from 75.7 in August and 81 in Sept. 2020. The share of consumers who felt it was a good time to buy a home dropped to 28% from

While

“In our view, other housing market fundamentals remain supportive of further home price appreciation — including low levels of inventory and

Freddie Mac’s average

Active

New-listing volume dropped 10% annually in September and hurt the market’s lower price tiers most, according to a separate report from HouseCanary. New single-family listings fell 27.1% year-over-year in the $0-to-$200,000 price range and 18.6% between $200,000 and $400,000. Meanwhile, they grew 0.7% from $400,000 and $600,000 and 3.1% between $600,000 and $1 million.

“We continue to see prospective buyers making above-list price offers on homes given the ultra-competitive market environment,” said Jeremy Sicklick, HouseCanary co-founder and CEO. “If the supply shortage holds through the winter, we could expect to see additional rapid price growth in spring 2022, but at a lower rate compared to 2021."

On the flip side, sellers rejoiced in Fannie Mae’s Home Purchase Sentiment Index. Constrained supply and price gains led 74% of HPSI surveyees to believe September was a good time to sell a home, up from 73% in August and 56% in September 2020.

The net share of consumers unconcerned about losing their jobs ticked down to 65% from 67% in both August and the year prior. A net 14% reported significantly higher household income over the past year, holding month-over-month and doubling from 7% annually.