Mortgage lenders have already begun to feel the burn of higher interest rates.

The net gain per loan originated for independent mortgage banks and mortgage subsidiaries of chartered banks dropped to $575 in the fourth quarter from $1,773 the previous quarter, the Mortgage Bankers Association found in its Quarterly Mortgage Bankers Performance Report. The figure was up slightly year over year from $493 in the fourth quarter of 2015.

"Rapid increases in interest rates in the last two months of 2016 slowed mortgage activity in the fourth quarter, driving a significant decrease in loan production profits," said Marina Walsh, MBA vice president of industry analysis, in a news release.

Average production volume dried up, falling to $690 million per company from $764 million in the third quarter. Volume by count dropped as well to an average of 2,811 loans from 3,072 loans. Additionally the average loan balance from a first mortgage slipped to $246,473 from a survey-high of $251,398 in the third quarter.

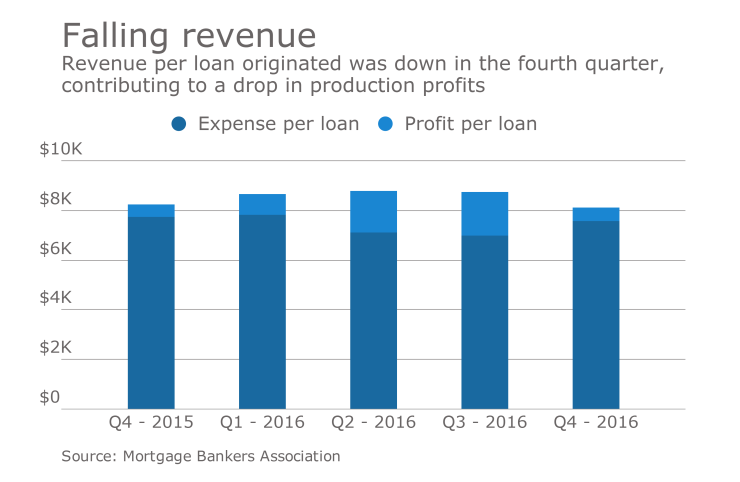

On a per-loan basis, production revenue fell to $8,137 in the fourth quarter from $8,742 the quarter prior, driven by a decrease in secondary marketing income as a result of less favorable pricing and pipeline challenges. At the same time, loan production expenses rose to $7,562 per loan in the fourth quarter from $6,969 in the third quarter, thanks to the drop in loan count.

Conditions were not as bad for lenders who hold servicing portfolios though.

"Those mortgage lenders with servicing portfolios benefited from higher net servicing financial income in the fourth quarter due to increases in the valuation of their mortgage servicing rights, driven by the same rising interest rates," Walsh said, noting that the reduced production profitability outweighed the servicing-related gains in most cases.

In the fourth quarter, net servicing financial income rose to a $34 per-loan gain in the fourth quarter from a $122 loss per loan the previous quarter.