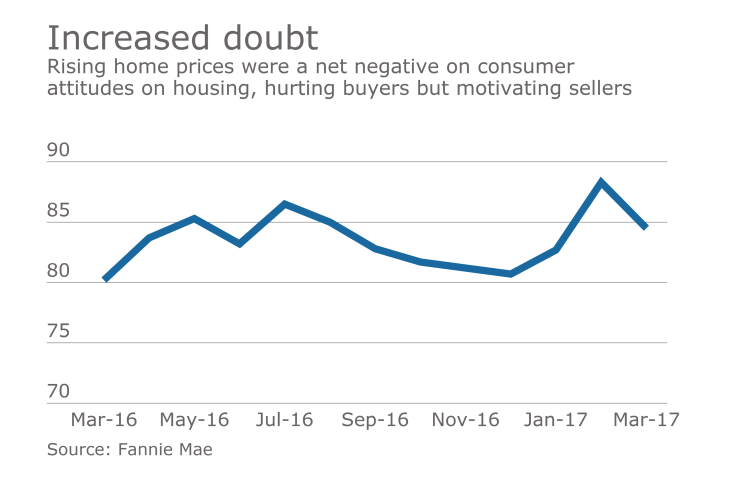

Home price increases combined with rising rates drove consumer confidence in the housing market off of its all-time high.

The Fannie Mae Home Purchase Sentiment Index fell 3.8 points to 84.5 in March, down from

There was a 10 percentage point decline to 30% in the share of Americans who said now is a good time to buy a home while the share who believe now is a good time to sell rose by nine percentage points to 31%.

That set a record high for the sell component and put it above the buy indicator for the first time in the history of the survey, showing that "strong home price appreciation has turned into a double-edged sword for the housing market," said Fannie Mae Chief Economist Doug Duncan in a press release.

High home prices were the most important reason for movement in both categories, cited by 39% of consumers who say it is a bad time to buy (a survey high) and 24% of those who say it is a good time to sell.

"In addition, the net share of consumers who expect mortgage rates (60%) to rise over the next year exceeded that experienced during the 2013 taper tantrum. However, the housing market could get some tailwinds from a seasonal rise in for-sale inventory, particularly as some sellers seek to lock in profits from recent rapid home price gains. The market could also get a boost from homebuyers who decide to jump into the market before rates rise further," Duncan said.