Residential mortgage-backed securities servicers are better able to weather a downturn and the resulting loan defaults today versus before the crisis because of their investments in technology and regulatory compliance, Fitch Ratings said.

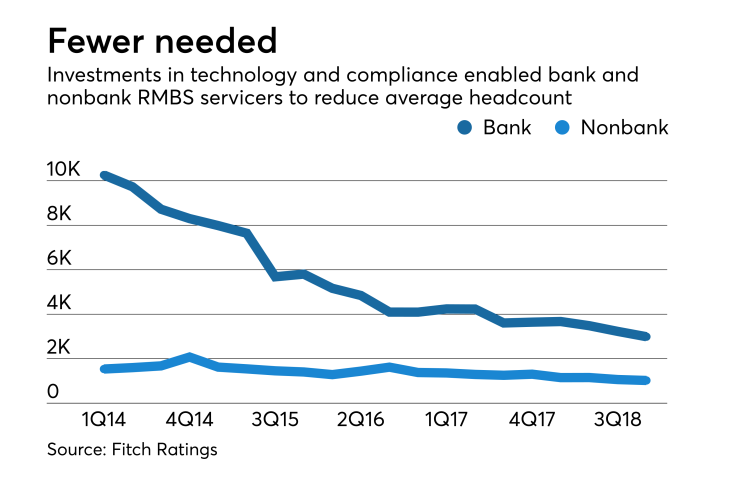

Those investments made over the past 10 years led to operational improvements. That, along with improved mortgage loan performance since the crisis, resulted in a decline in employment by 71% for bank servicers and 33% for nonbank servicers over the past five years.

"Improved systems allow servicers to respond more quickly to unexpected events, as evident by strong delinquency recoveries after recent

For the third quarter of 2018, there were 2,989 average full-time employees at bank RMBS servicers and 1,021 at nonbanks.

This is way down from June 30, 2011, when there were 15,419 average full-time employees at bank RMBS servicers. By the first quarter of 2014 that fell to 9,729, and by the first quarter of 2017 it was down to 4,232.

The peak employment for nonbank RMBS servicers was the second quarter of 2013 at 2,150 average FTEs. It was above 2,000 FTEs again in the third quarter of 2013, reached another peak at 1,619 FTEs in the second quarter of 2016, before trending down again.

Another positive is that the mortgage servicing function has become less concentrated in the past five years. The top 10 servicers by unpaid principal balance controlled 80% of the market as of the third quarter of 2018, down from 93% five years prior, based on data from the companies Fitch rates.

This shift is a mitigating factor to disruption risk during a downturn, because a transfer or consolidation of a distressed servicer's portfolio remains a viable alternative, Fitch said.

Previously, Fitch noted that nonbank RMBS servicers