A decline in overall customer brand perception has stalled mortgage servicer satisfaction, ending a multiyear trend of steady improvements, according to J.D. Power.

The digital space is key for servicer success, as customers utilizing a website to communicate and submit payments are on average 43 points more satisfied than those who don't.

The brand perception decline is led by a significant increase in customers citing their mortgage servicer being focused more on profit than its customers, which could have long-term effects on future business.

While the industry average satisfaction is 754, satisfaction among customers visiting their servicer's website three or more times in the past 12 months is 789.

Craig Martin, director of mortgage practice at J.D. Power, described three areas of opportunity to help drive success for mortgage servicers — effective onboarding, high-functioning self-service tools and call center best practices.

"The past few years have not been easy for mortgage servicers as they've struggled with regulatory and market pressures, but still managed to deliver on customer satisfaction. Now, as that trend starts to shift and customer satisfaction levels off, it is critical that mortgage servicers continue to balance the demands of this tough marketplace with the needs of their customers," said Martin in a press release.

When onboarding satisfaction is high, customers are more likely to use a servicer's website for communication and payment, and less likely to have used a call center or experienced a problem.

When customers believe their time is being wasted, overall satisfaction drops 285 points. About 66% of those customers indicate waiting five or more minutes to speak with a customer service representative.

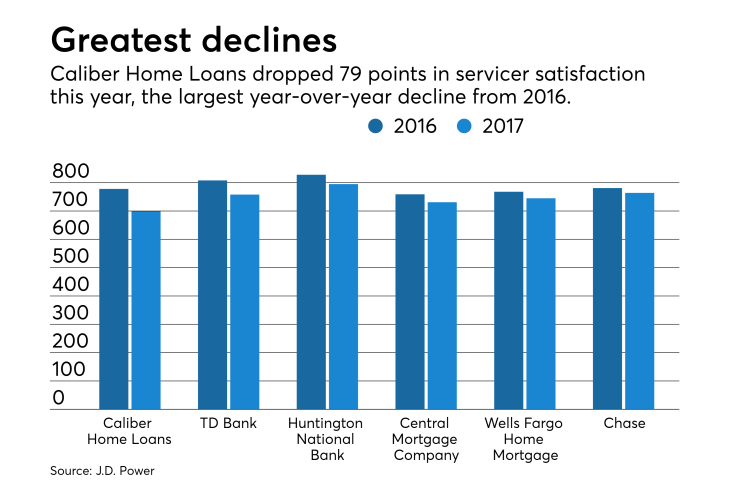

Among servicers showing noticeable improvements are Ditech Financial, jumping 37 points from last year, Nationstar Mortgage, increasing by 29 points, and Bank of America, rising 26 points to 767 in 2017.

With a score of 840, Quicken Loans is the top-rated mortgage servicer for the fourth consecutive year.

Mortgage servicer satisfaction is calculated on a 1,000-point scale and measured through feedback from the following categories: new customer orientation, billing and payment process, escrow account administration, interaction, mortgage fees and communications.