-

For the second time in the past three J.D. Power polls, Rocket Mortgage has been dislodged from the top spot.

November 16 -

Problems with self-service tools and inconsistent communication have damaged consumer perception of their lender, J.D. Power said.

November 9 -

The company expects to get between $17 and $19 per share.

October 15 -

The annual survey and ranking of mortgage servicers found that while trust is increasing, borrowers were frustrated with some digital interactions and long wait times with call centers.

July 30 -

Guild Mortgage CEO Mary Ann McGarry is giving up the president's title as the San Diego-based company continues its national expansion plans.

November 18 -

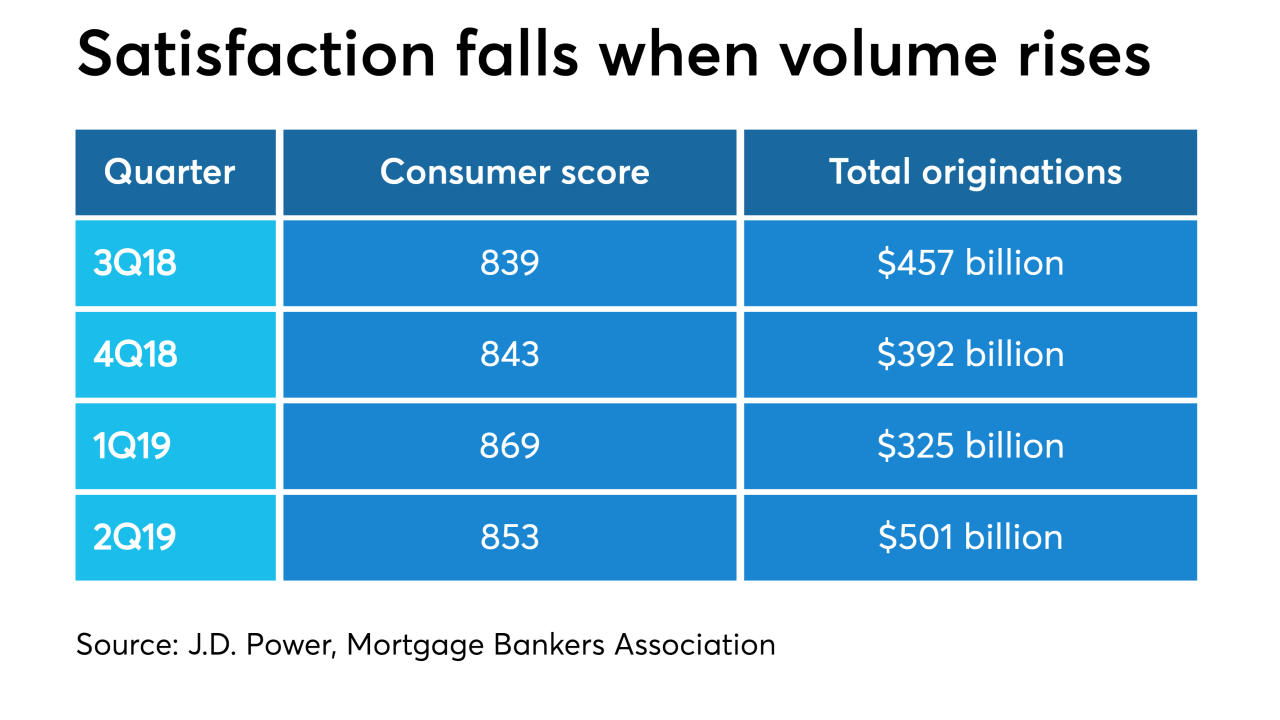

Consumer mortgage originator satisfaction scores fell in the second quarter as lenders had to work through the increase in application activity, a J.D. Power report said.

November 14 -

Mortgage servicer customer satisfaction levels are among the lowest of any industry as more companies prioritize cost-cutting, regulation and default management over their borrowers, according to J.D. Power.

August 1 -

Point, which provides an alternative to traditional home equity lending products, has raised $122 million in new capital from eight investors to expand its reach.

March 20 -

Having an all-digital process results in lower customer satisfaction for home equity line of credit providers than an all in-person or a mix of methods, a J.D. Power survey found.

March 14 -

Assessing the implications of big tech's inevitable next run at the business of mortgage lending.

March 6 -

As the industry shuffles closer to completely digital mortgages, the next wave of technology aims to usher in total automation and uniformity.

January 16 -

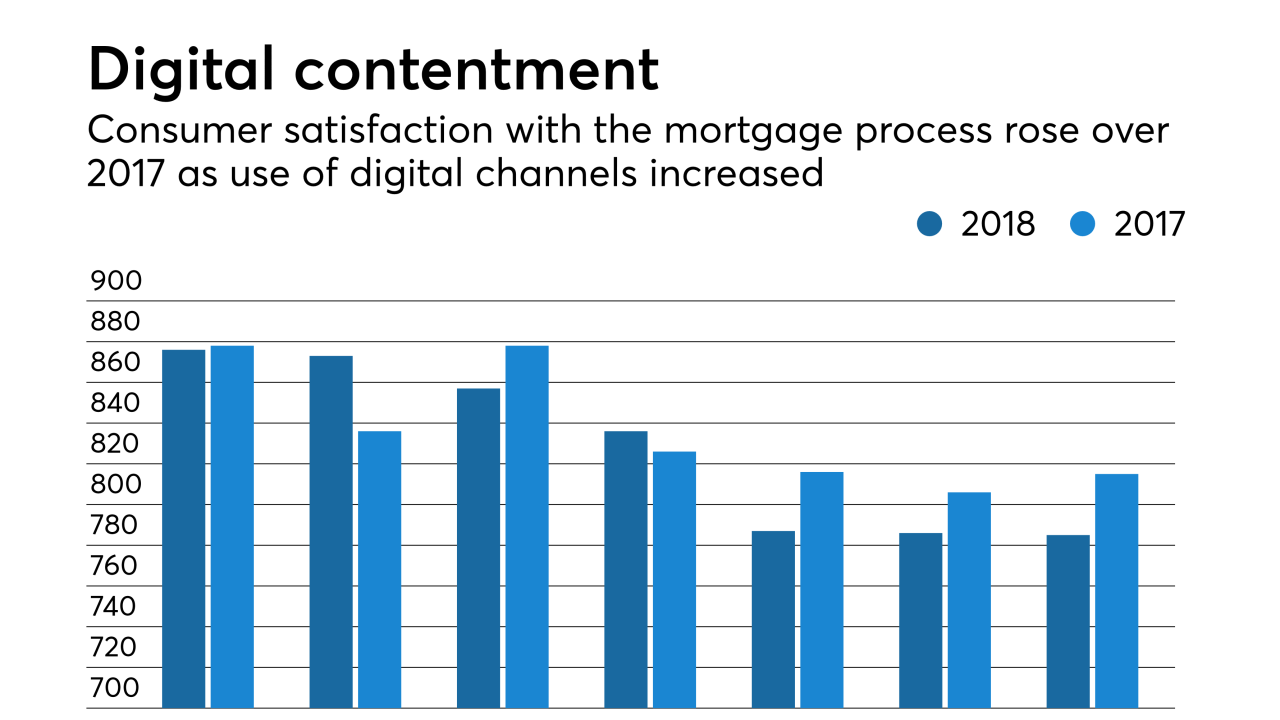

The growth of digital mortgage origination channels has improved customer satisfaction with the process, but consumers still want personal interaction at some point, according to J.D. Power.

November 8 -

Investments in technology and emphasis on user experience contributed to an increase in the average satisfaction score for mortgage servicers, according to J.D. Power. Yet only a fifth of customers use mobile platforms.

July 30 -

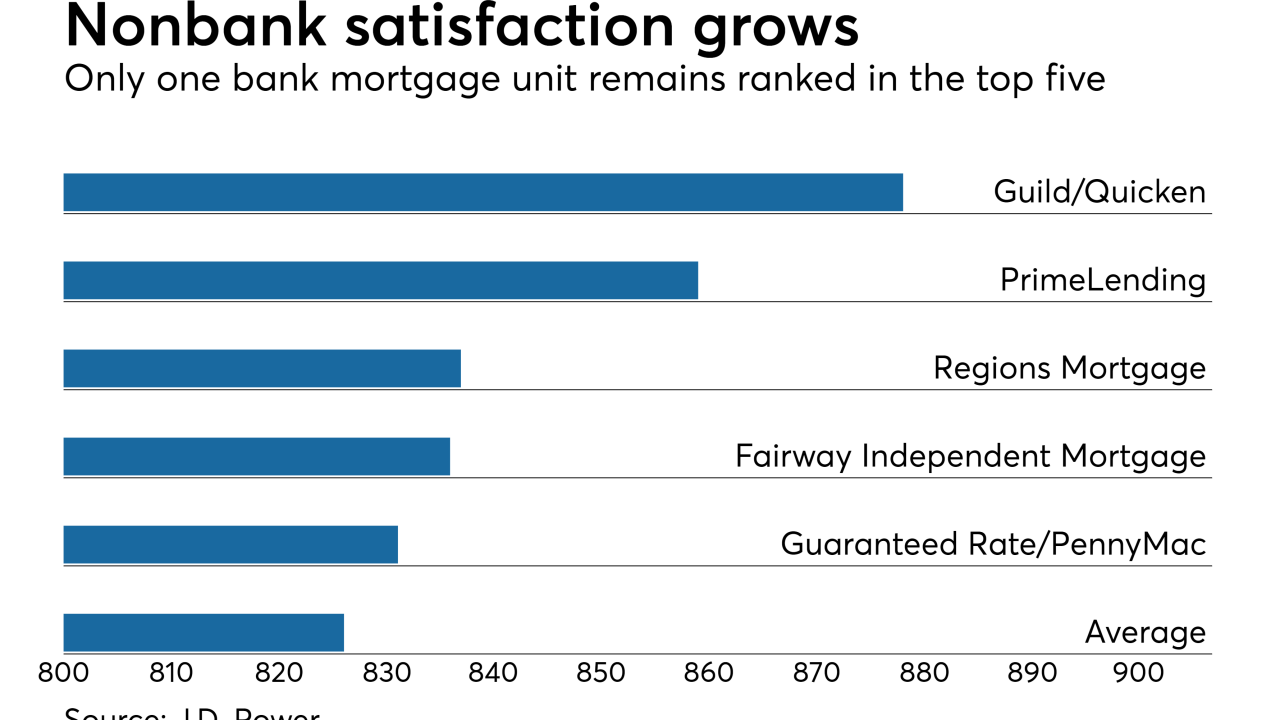

Despite digital mortgage advances, borrowers think it still takes too long to get a loan, J.D. Power finds in its annual customer satisfaction ranking of originators.

November 9 -

A decline in overall customer brand perception has stalled mortgage servicer satisfaction, ending a multiyear trend of steady improvements, according to J.D. Power.

July 27